ETHA Erupts: Record Growth to $10 Billion in Record Time

Ethereum exchange-traded fund ETHA, managed by BlackRock, has reached a benchmark $10 billion in assets under management (AUM) for the first time, achieving the third-fastest ascent to this milestone in U.S. ETF history. This milestone surpasses the record pace previously held by the two leading spot Bitcoin funds, IBIT and FBTC.

Record-Tying Achievement

ETHA crossed the $10 billion threshold after just 251 days, significantly outpacing IBIT (34 days) and Fundrise Wise Bitcoin Trust (FBTC) (53 days), according to Bloomberg data analyzed by Bloomberg Senior ETF Analyst Eric Balchunas.

Latest Surge Highlights Explosive Growth

Even more recently, ETHA experienced a record-breaking 10-day period ending Wednesday, adding $5 billion in assets since hitting the $5 billion mark. This represents the shortest timeframe ever for any ETF to quintuple its size based on asset growth.

““That five [billion] to $10 billion move, most of that’s the price, although the flows were really robust too,” Eric Balchunas told Decrypt. “So it was a nice combination of both. But I don’t think I’ve ever seen an ETF grow that quickly. This is very weird stuff,” he added.

Price and Fund Flows Entwined

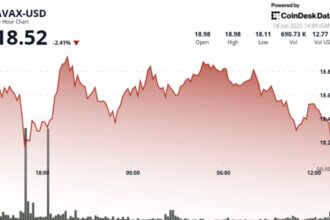

Ethereum’s price performance has closely followed the rapid inflows into ETHA. On Monday, ETH reached its highest level since December, approaching $3,850 before pulling back slightly to around $3,710. Analysts suggest a feedback loop exists between the price appreciation and fund inflows, though the precise causal relationship (“tangoing flows and price”) remains uncertain.

Broader Trend for Ethereum ETFs

Federal legislation, specifically the recently passed GENIUS Act, is noted as a factor enabling the growing demand for Ethereum ETFs, anticipating benefits for Ethereum’s role as the dominant platform for stablecoin transactions.

Moreover, ETHA is part of a broader trend, with U.S.-listed Ethereum ETFs showing significant inflows, exceeding $1.1 billion over the first three days of the prior week alone. However, despite this growth, Ethereum ETFs as a category lag behind their Bitcoin counterparts, which dominate the market with over $140 billion in combined AUM.

Analysts like Eric Balchunas and Sumit Roy highlight the surge in interest from stablecoin markets and Ethereum treasury companies as key catalysts finally tipping the scales and signaling sustained demand for Ethereum derivatives accessible via traditional finance channels.