Bitcoin Miners Rebound as Market Surges Post-Dip

Bitcoin miners face a stark contrast between recent struggles and current recovery, as the cryptocurrency’s price recently surged past previous all-time highs following a significant downturn.

Market Volatility and Miner Struggles

Earlier this year, Bitcoin miners endured hardship due to a substantial price decline. President Trump’s tariff announcements, in particular, triggered a nearly 20% drop, pushing the price below $75,000 and straining operations.

Recent Recovery and Production Growth

The market has since rebounded, with Bitcoin reaching an all-time high exceeding $111,000 in late May, currently trading near that peak. This price recovery has spurred increased mining activity and production.

- Publicly traded mining company Bitdeer reported minting 196 BTC in May (approximately 18% more than April), significantly boosting its output.

- The company also increased its computational power (hashrate) to 13.6 exahash per second (up from 12.4) by incorporating new machinery.

- Data indicates that four other top mining firms (CleanSpark, MARA, Riot Platforms, HIVE) followed suit by increasing their Bitcoin production compared to April.

Industry Headwinds and Recovery Factors

The year has presented significant challenges for Bitcoin mining, driven by reduced block rewards combined with persistent price volatility.

- The halving event earlier last year cut miner rewards in half, reducing the incentive for operation.

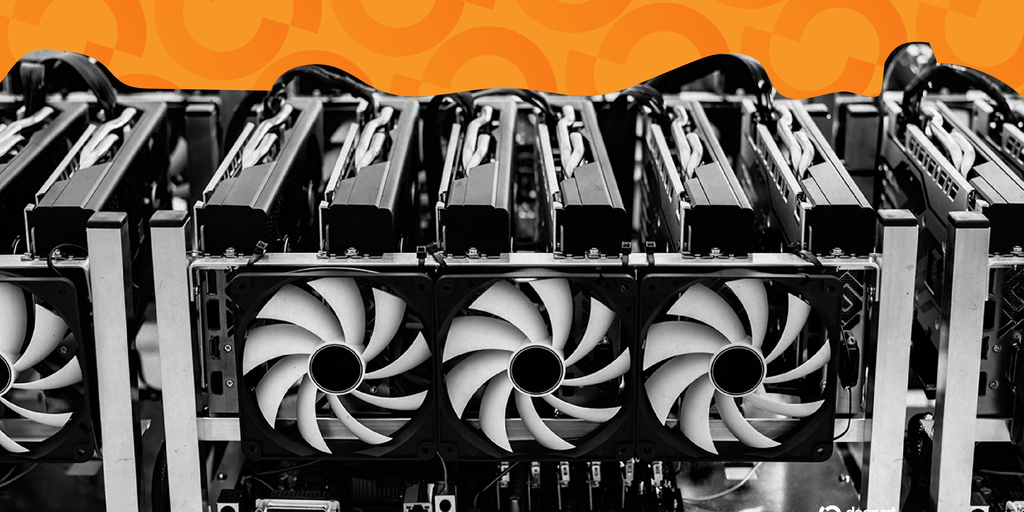

- Current Bitcoin production (sufficient to produce the reported increases) requires substantial capital investment in specialized equipment and enormous energy consumption.

- Following last year’s reward reduction, miners now earn approximately $340,000 worth of Bitcoin per block verification, underlining the operational demands.

- To offset costs, miners historically sold excess coins. With the price recovery, this pressure has lessened, contributing to the reinvigorated production.

Bitcoin mining operations consist of large facilities housing specialized computers competing to solve complex problems and add validated transaction blocks to the immutable digital ledger. Success requires significant investment and faces regulatory uncertainties, including President Trump’s stated goal of consolidating US-based mining production.