Opinion by: Irina Heaver, crypto lawyer

The Crypto Market’s Reset: Real-World Assets Stepping into the Spotlight

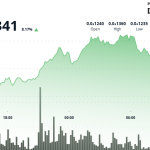

The cryptocurrency markets are undergoing a significant correction. The speculative fervor of 2021, marked by memecoins and complex DeFi derivatives, has cooled considerably.

Investor focus has shifted from ephemeral digital speculation towards assets with demonstrable intrinsic value. After years of chasing “vapor,” demand is now centered on tangible assets, yield potential, and robust infrastructure. This convergence highlights the growing appeal of Real-World Assets (RWAs).

In a market weary of pump-and-dump schemes, RWA tokenization offers a compelling combination: proven value, potential returns, and access, delivered on-chain. Unlike projects burdened by misleading white papers and token distribution problems favoring insiders, RWA tokens represent established assets like real estate, commodities, and luxury goods.

Real Estate Leading the Charge in Dubai

Amidst global RWA categories, real estate tokenization stands out notably. In the United Arab Emirates, particularly Dubai, several factors position this asset class for rapid growth.

Tokenization has revolutionized access to high-value real estate. No longer is substantial capital required upfront. A smartphone and a few hundred dollars can unlock fractional ownership in luxury villas, downtown apartments, or high-yield rental properties.

This aligns with Dubai’s longstanding goal of democratizing investment. Crucially, this vision is now operationalized through law. In May, Dubai’s Virtual Assets Regulatory Authority (VARA) updated its regulations, creating a dedicated category for Asset-Referenced Virtual Assets (ARVAs). This framework specifically permits the compliant tokenization of tangible assets like real estate.

Dubai’s Regulatory Framework and Market Activity

The VARA ARVA framework establishes a secure, regulated environment for issuing and trading tokenized real estate. Issuers must acquire the Category 1 VARA license, meet stringent capital requirements, undergo comprehensive audits, publish verified information, and ensure transparent disclosures. This structured approach fosters trust and injects global capital markets.

The framework is yielding tangible results. Last month, the Dubai Land Department, VARA and major developers facilitated the tokenization and sale of two high-demand apartments. The offering scooped up rapidly, selling out within minutes. Notably, 70% of buyers were first-time real estate investors in Dubai, demonstrating the genuine appeal for global retail investors equipped with crypto wallets. Tokenization was the enabling factor.

The advantages extend beyond retail investors. Developers gain access to international capital, bypassing traditional constraints such as equity dilution, burdensome debt negotiations with banks, or inefficient fundraising efforts.

Investors benefit from enhanced diversification, now able to spread investment across multiple properties rather than concentrating capital in a single deal. Furthermore, Dubai’s consistently strong rental yields present a compelling value proposition.

The Catalyst: UAE Regulatory Clarity

Why is this happening now? In an era of macroeconomic uncertainty, capital naturally flows towards hard assets. Commodities like gold and oil are regaining interest. The UAE, by offering both regulatory clarity and substantive market access, is positioned perfectly.

The UAE’s approach is particularly effective. Rather than struggling to fit blockchain innovation into outdated frameworks — as attempts in places like the US highlighted — authorities established a new, purpose-built system.

Legacy attempts, such as the St. Regis Aspen Resort project and the aborted New York Plaza Hotel tokenization, faced significant hurdles: operational complexities, limited accreditation requirements, regulatory delays, and inefficient technological implementations on early blockchains. These challenges, however, underscored the necessity for Dubai’s robust approach.

The UAE’s ARVA framework provides the necessary rails for a mature RWA market. This makes it a strategic consideration for founders building platforms, venture capital firms seeking infrastructure plays, family offices diversifying, and developers seeking alternative funding mechanisms. Ignoring Dubai’s RWA tokenization landscape is increasingly challenging.

Dubai Coming to the World, Digitally

While historically the UAE’s regulatory mandate was, as one regional saying goes, “Habibi, come to Dubai,” the landscape is evolving. Today, the UAE itself is bringing digitized opportunities to global investors through tokenized real-world assets.