NIP Group Acquires Bitcoin Mining Rig Fleet After Major Stock Decline

Esports powerhouse NIP Group stated that it’s acquiring an undisclosed quantity of Bitcoin mining equipment. This venture attempts to address some of the repercussions from a stock value that has fallen 88% since reaching an all-time high mere months ago.

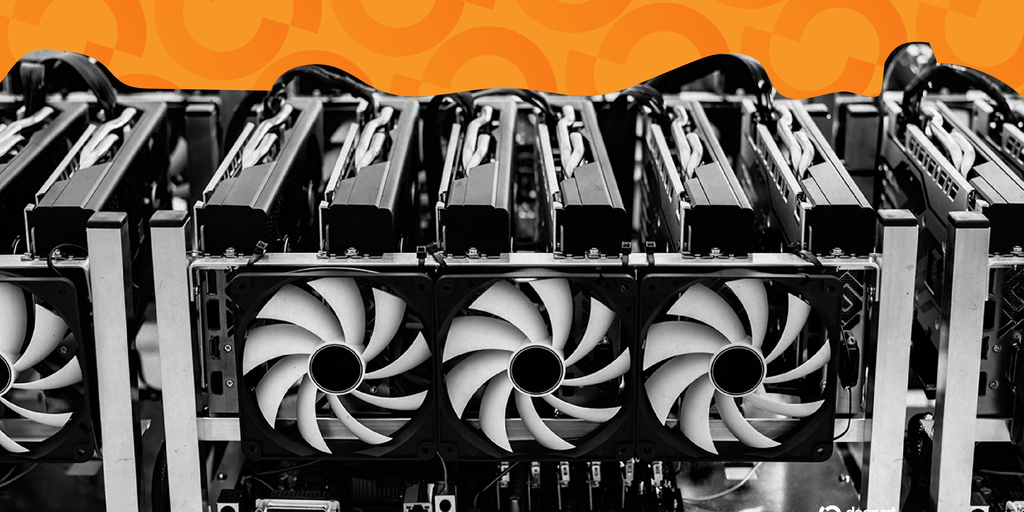

The parent entity of the globally recognized esports franchise Ninjas in Pyjamas (NiP) has procured an undisclosed portion of Bitcoin mining gear to initiate a dedicated cryptocurrency operation.

NIP Group estimates that its nascent mining endeavor, utilizing rigs totaling 3.11 exahashes per second (EH/s) computation power, will yield roughly 60 Bitcoin (BTC) monthly. Currently valued at approximately $6.5 million, this projection represents a substantial, yet potentially challenging, revenue stream given the substantial electricity costs involved.

Acting under the Digital Computing Division established within the company, NIP Group aims to manage both its present and impending mining activities. Crucially, the company has not disclosed its intentions regarding the Bitcoin it is expected to accumulate.

Despite NIP Group’s branding as an esports entertainment entity, its most renowned asset remains the NiP esports organization. Competing at the elite level in games such as Valorant, League of Legends, and Rocket League, NiP famously held the Counter-Strike: Global Offensive record win streak from 2012-2013.

Commenting on the venture, NIP Group founder and Chief Executive Officer Hicham Chahine noted via LinkedIn that the diversification moves are part of a strategy initiated after the company’s recent IPO. He stated the investment aligns with the company’s future as a “next-gen digital infrastructure company,” anticipating further expansion within the field.

Effectively, NIP Group’s diversification move seems to have arrived as its stock is under considerable pressure. Following the announcement, the stock price dropped 17% to $2.13. This brings its market value down 88% since a previous all-time high of $17.76 in July.

NIP Group’s foray into direct Bitcoin mining mirrors a broader trend observed in public markets, echoing the success of firms like MicroStrategy. The latter company, since its transformation led by Michael Saylor, has acquired enormous Bitcoin reserves worth over $65 billion.

Utilizing industry terminology, analysts term NIP Group’s action establishing a Bitcoin treasury—a financial strategy now being employed by several other companies pursuing significant cryptocurrency allocations.