DDC Enterprise Raises $528M for Bitcoin Treasury Strategy

Hong Kong-based food products company DDC Enterprise Limited announced today the closing of a $528 million capital raise. The funds are earmarked for the company’s aggressive strategy to accumulate Bitcoin in its corporate treasury.

- The company aims to purchase 5,000 BTC over the next three years.

- This brings the number of publicly traded firms investing in Bitcoin into the hundreds, following a trend popularized by MicroStrategy.

- DDC Enterprise trades on the NYSE American exchange.

DDC sourced the financing through three separate securities offerings and established an $818 million equity line of credit during the transaction. Key participants included crypto-native investment firms and venture capital entities.

The company noted that the capital commitment represents a “watershed moment.” In a statement, CEO Norma Chu stated, “This maximum aggregate $528 million capital commitment marks a watershed moment for DDC… We believe we have unprecedented capacity… to become a top global Bitcoin holder.”

DDC already holds an initial 138 BTC, acquired earlier at an average cost of approximately $78,582 per BTC, ahead of Bitcoin’s current price surpassing $105,000.

Beyond its Bitcoin treasury, the company operates brands focused on ready-to-eat meals and other packaged convenience foods with an Asian culinary focus.

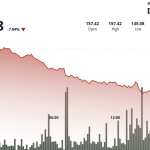

Following the news, DDC’s stock experienced a decline of nearly 3%.

DDC Enterprise’s substantial investment strategy occurs within a larger movement of public companies following MicroStrategy’s lead. Currently, over 140 listed companies hold a combined value of approximately $90.9 billion worth of Bitcoin, as per available data.