JP Morgan Unveils JPMD Deposit Token on Ethereum Layer-2 Network Base

In a move poised to reduce settlement times for commercial transactions, JP Morgan Chase announced plans Tuesday to pilot a new deposit token named JPMD on the Ethereum layer-2 network Base.

Typically, interbank settlement can take days. JP Museum aims to facilitate near-instant payments.

The token, defined by JP Morgan as “commercial bank money–transferable tokens issued on a blockchain by a licensed depository institution which evidence a deposit claim against the issuer,” according to its white paper, will initially be used by approved Coinbase institutional clients participating in the pilot program.

The pilot is scheduled to run for several months. Following regulatory approval, broader access for other users and expanded currency denominations are anticipated.

JP Morgan’s global blockchain head, Naveen Mallela, confirmed in a Tuesday interview with Bloomberg News that the bank plans to transfer an undisclosed amount of JPMD to Coinbase via Base shortly.

The Base network, operated by Coinbase, is an Ethereum scaling solution designed to facilitate faster and cheaper transactions.

Base commented in a social media statement, “Moving money should take seconds, not days. Commercial banking is coming on-chain.”

The launch announcement aims to clarify earlier market speculation that JPMD could potentially function as a stablecoin (a digitally backed currency with minimal price volatility). The rumors gained significant traction on social media Monday following details shared in JP Morgan’s filing with the U.S. Patent and Trademark Office.

The rumors are particularly relevant given the ongoing legislative efforts surrounding stablecoins in the U.S. and JP Morgan’s increasing interest in the cryptocurrency sector.

JP Morgan has been involved with blockchain technology since at least 2020 through its Onyx division (now rebranded as Kinexys), which handles trillions in daily transactions. The bank previously reported discussions in May regarding the potential creation of a jointly-issued stablecoin.

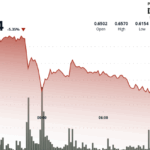

Premarket trading for JP Morgan (JPM) stock was down approximately 0.8% following Tuesday’s announcement.