MicroStrategy Reinforces Bitcoin Streak Amid Market Scrutiny

MicroStrategy, bolstered by co-founder Michael Saylor, continues its record-setting purchase streak of Bitcoin.

Strategy CEO Saylor declared the 11th consecutive week of active Bitcoin (BTC) buying publicly on Tuesday, underscoring a position initiated on April 14th.

Appealing to his substantial following, he noted, "In 21 years, you’ll wish you’d bought more," expanding his recent social media influence to over 4.4 million followers.

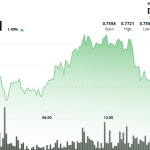

The company persists in its accumulation, with the latest transaction occurring on June 23rd. That operation involved procuring an additional 245 BTC at an approximate cost of $26 million.

This action increased the company’s Bitcoin treasury to a total of 592,345 BTC, marking a market value exceeding $63.6 billion.

Maintaining this substantial treasury positions MicroStrategy as the single largest known corporate holder of Bitcoin globally.

Public data from BitcoinTreasuries indicates its holdings represent more than double the combined BTC reserves of the top 20 competing public entities holding Bitcoin in treasury.

This dominance has fueled ongoing debate among analysts: whether corporate accumulation on this scale will trigger a supply shock, potentially driving up BTC’s price.

Alternatively, concerns persist regarding the sustainability of the corporate treasury model, particularly as copycat firms attempt similar strategies by financing Bitcoin purchases with debt and equity.

Echoing this uncertainty, venture capital firm Breed recently warned readers: “Those types of future treasury bull market themes are definitely becoming limited.”

Looking forward through potential market cycles, Breed suggests significant consolidation within the treasury sector may be inevitable.

“When failures inevitably hit, the strongest players are likely to acquire distressed companies and consolidate the industry,” the report stated.

Newer ventures face amplified peril, analysts add, due to harsher capital raising conditions and stringent leverage requirements they must meet.

The Massachusetts native’s firm, historically funded and insulated by Oracle founder Larry Ellison, is seen as having significantly greater resiliency than its newer competitors.

Strategy the authors further highlighted its survival through previous market downturns as critical evidence of its operating discipline.

Market analyst Jeff Walton has forecasted a heightened probability of MicroStrategy achieving prominent market recognition. He estimates a 91% chance of the company joining the S&P 500 index in Q2 2025.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.