MicroStrategy Considers New Bitcoin Purchase Amid Middle East Geopolitical Tensions

Despite ongoing Middle East conflict concerns potentially rattling global markets on Monday, MicroStrategy (MSTR) co-founder and CEO Michael Saylor has indicated the company is preparing a significant new investment in Bitcoin (BTC).

The company’s most recent BTC purchase occurred on June 9, acquiring 1,045 BTC valued at approximately $110 million. This brings MicroStrategy’s total Bitcoin holdings to approximately 582,000 BTC (source: SaylorTracker).

Since inception, MicroStrategy’s Bitcoin investment has increased by over 50%, delivering more than $20 billion in unrealized fiat value.

Resilient Crypto Market Amidst Escalating Tensions

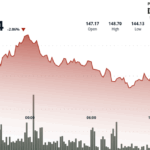

Israel launched airstrikes against Tehran—the capital of Iran—late Thursday. Following initial reports of strikes, the Bitcoin price experienced a brief decline of roughly 3% but has since stabilized near the $105,000 level.

Contrary to expectations amid heightened geopolitical risks, trading volume and confidence saw a surge. Crypto markets demonstrated resilience, with Bitcoin exchange-traded funds (ETFs) recording five consecutive days of inflows this week.

Farside Investors data shows these Bitcoin ETFs saw a net inflow of over $1.3 billion this week. Simultaneously, the Crypto Fear and Greed Index remains elevated at 60, signaling investor “greed” and overall bullish sentiment.

Strategic Positioning Amid Global Uncertainty

Saylor’s announcement follows a clear sign of investor confidence in Bitcoin, regardless of escalating geopolitical uncertainty surrounding the conflict and potential broader market jitters ahead of Monday’s financial market open.

While difficult to quantify, the continued accumulation suggests an enduring belief in Bitcoin’s role as a store of value amidst economic and geopolitical instability.

This potential accumulation underscores Bitcoin’s strategic positioning beyond traditional fiat assets during periods of global uncertainty.

Potential Near-Term Risk: Strait of Hormuz Disruption

Coin Bureau founder and market analyst Nic Puckrin warned that further Iranian escalation, such as closing the Strait of Hormuz, could negatively impact risk asset prices, including cryptocurrencies, in the near term.

The crucial waterway handles approximately 20% of the world’s oil shipments, and any disruption would significantly push up energy costs, affecting global markets and business operations.

Cryptocurrency Price Resilience Shows Market Adaptability

Despite genuine vulnerability underscored by the conflict’s potential impact on global oil supplies and energy prices, cryptocurrency pricing showed remarkable resilience immediately after the conflict began.

Energy costs being integral to all economic sectors, any sustained sharp increase would ultimately present challenges across global financial standing, a recognized danger by market observers.