SharpLink Gaming Secures Major Ethereum Acquisition, Stock Slump Follows

Online gambling marketer buys $460m worth of Ethereum.

Acquisition and Holdings

- SharpLink Gaming announced a $462 million, stake in Ethereum, citing network security and yield generation as objectives.

- The acquisition, averaging approximately $2,600 per ETH coin, positions the company as the largest publicly traded holding of Ethereum.

- As of Friday’s blog post, over 95% of acquired ETH was allocated to “staking and liquid staking solutions,” primarily via the Lido protocol, according to Decrypt.

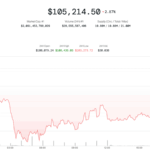

The company revealed it holds roughly 176,000 ETH, making its holdings $540 million at current values (as per Arkham Intelligence). While currently trailing the Ethereum Foundation’s reserves, analysts note that SharpLink stated its stake ranks second only to the Foundation on a broader scale.

Market Reaction and Clarification

- SharpLink’s stock experienced a significant drop, falling over 70% during after-hours trading following the announcement.

- Fear of dilution from subsequent stock offerings and speculative trading movements added to investor concerns, driving down initial trading.

- Co-founder Joe Lubin later clarified an SEC filing, stating it was a standard shelf prospectus designed to facilitate future Ethereum purchases, not an immediate share sale.

“That’s resolved once all the filings [are] done. […] It doesn’t mean anyone ‘rugged,’” one market observer noted.

Strategy Comparison

SharpLink’s ability to generate yield from its Ethereum holdings contrasts with Bitcoin treasury firms, due to the networks’ differing consensus models.

Financing Details

- SharpLink acquired its stake through a combination of a PIPE transaction ($462 million ETH + $79 million equity raise).

- Additional capital under the firm’s equity ATM program allows for further Ethereum accumulation up to $1 billion.

Analysis: The move underscores the growing interest of regulated entities in cryptocurrency treasury management. While driving considerable discussion and speculation, SharpLink’s Ethereum deployment highlights the practical application of Layer 2 staking solutions like Lido. However, the precipitous stock drop reflects cautious financial markets amidst regulatory uncertainty and significant speculation around the company’s growing crypto profile.