In brief

- Bitcoin-buying firms offset Galaxy Digital’s massive Bitcoin sale, according to CEO Mike Novogratz.

- Firms acquiring crypto assets continue to underpin prices, Novogratz noted.

- Galaxy Digital partners with over 20 crypto asset treasury firms.

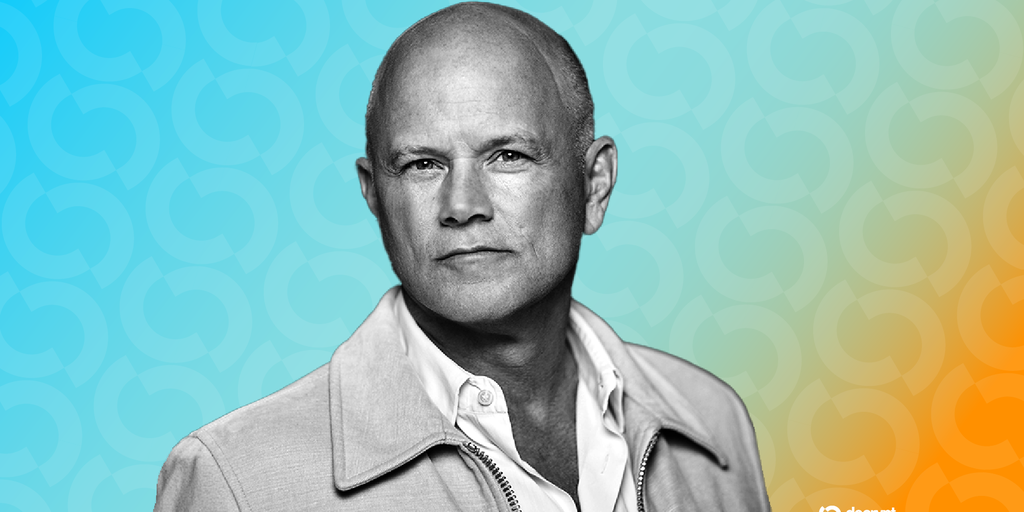

Galaxy Digital CEO Mike Novogratz expressed relief Tuesday following the execution of a significant Bitcoin sale. The company, tasked with liquidating 80,000 Bitcoin on behalf of a client, saw the transaction absorbed nearly instantaneously by Bitcoin treasury firms during a “pivotal” market period.

“It was a combination of grace, luck, fortune, and timing,” Novogratz stated during the firm’s second-quarter earnings broadcast. “There was a tremendous amount of buying coming from these balance sheet companies.”

The influx of buying pressure stemmed primarily from established entities accumulating Bitcoin reserves and a wave of newer firms entering the market. Novogratz highlighted Strategy (formerly MicoStrategy), which purchased 21,000 BTC worth $2.3 billion, and Trump Media and Technology Group (owner of Truth Social), which acquired 18,400 BTC worth $2 billion, as major drivers of demand.

“Demand met supply,” Novogratz asserted. “As long as that continues, crypto prices are going to look pretty good.”

While the focus was on Bitcoin, similar institutional buying momentum has impacted Ethereum. Companies including SharpLink Gaming and BitMine Immersion have reportedly allocated substantial sums weekly to this cryptocurrency.

Galaxy Digital announced the large sale late last month. The company, which went public on Nasdaq in May, reported a second-quarter profit of $30.7 million, missing analyst expectations. Its shares closed Tuesday down 5.6% following Novogratz’s comments, though they remain up 13% year-to-date through July. Novogratz noted July was the best month ever recorded for their digital assets operating business.

Galaxy CEO Novogratz emphasized the strategic value of partnerships with cryptocurrency treasury firms. “We want to service those,” he said, noting collaborations with over 20 firms have generated “recurring income that will hopefully grow” by managing assets and executing transactions across the crypto landscape.