In Brief

- American Bitcoin, a crypto mining company

Backed by Donald and Eric Trump - Announced today in an SEC filing

It holds 215 Bitcoin valued at $23.7M - Their Bitcoin holdings represent

Value ahead of an expected IPO via merger - The filing positions Bitcoin

As “the business” they are in

American Bitcoin, the crypto mining enterprise founded by Donald Jr. and Eric Trump (or derived), has formally declared its substantial accumulation of Bitcoin following its emergence onto the financial stage this year. In a recent disclosure to the U.S. Securities and Exchange Commission (SEC), details surfaced that the company had successfully acquired 215 Bitcoin units, mirroring the approach pioneered years ago by tech giant MicroStrategy.

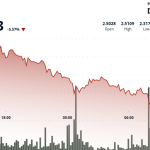

This significant portfolio, valued at approximately $23.7 million based on a recent $110,313 price per Bitcoin according to CoinGecko data, was disclosed in an official filing dated June 6. The filing states this Bitcoin serves as a “core strategic asset,” essential for financial stability and aimed at bolstering long-term shareholder value.

In the filing, the company asserted, “Bitcoin accumulation is not a side effect of ABTC’s business. It is the business,” indicating a deliberate strategic shift away from being solely a mining operation towards accumulating Bitcoin itself. Furthermore, American Bitcoin aims to continue expanding its on-chain reserves, guided by ongoing market assessments.

American Bitcoin’s accumulation fuels speculation that this move comes in preparation for the company’s post-listing scenario. It is scheduled to go public later this year through a merger with Gryphon Acquisition Corp.. This strategy positions the firm alongside what appears to be a nascent First Family empire deeply rooted in cryptocurrency and blockchain technology, significantly beyond the sphere of the iconic founder.

An analysis conducted as of June 7 highlights that over 100 publicly traded companies have established “cryptocurrency treasuries,” typically focused on Bitcoin, further validating this move as a rising trend in corporate finance.

Amidst this accumulation by American Bitcoin, the broader activities of the Trump family concerning digital assets have become increasingly prominent and controversial. While these operations are often conducted under separate corporate entities or a decentralized finance (DeFi) platform called World LibertyFi, the concentration of crypto assets within the extended Trump family forms a distinct “First Family conglomerate” focused exclusively on digital finance, according to some analysts.