Here is the rewritten HTML article content:

Coinbase Breaks Record Despite Bitcoin Weakness

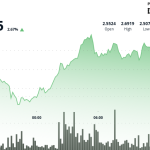

New York (MarketScreener) – Coinbase (COIN) stock reached a new high on Monday, peaking at $398.50, as its market capitalization surpassed the $100 billion threshold.

- Coinbase trade volume remains robust.

- This follows Bitcoin’s dip from its recent record high.

Analyst Ratings Upbeat

Argus Research analysts recently rated Coinbase stock a “Buy” with a $400 price target. They expressed confidence in the company’s prospects, anticipating that the likely passage of theGENIUS Act—providing a stablecoin regulatory framework—is poised to spur further development and adoption in the sector.

Coinbase stock dipped slightly in after-hours trading on Monday to close at $394.22, following its intraday peak.

Fundamentals Support Premium Valuation

Argus highlighted Coinbase’s impressive growth record and significantly better gross margins compared to industry peers as justifications for its premium valuation, particularly in a bull market. Key metrics cited included a 76.45% year-over-year revenue growth and an 85.25% gross profit margin.

Analysts noted this robust stock performance occurs even as Coinbase’s stock has risen 60% over the last month, spurred by a favorable political climate, soaring crypto asset prices, and strategic acquisitions planned to enhance service offerings.

Several reputable firms have recently revised upward their price targets on Coinbase stock, underscoring confidence in its long-term trajectory despite fluctuating short-term valuations.

Potential Regulatory Boost

Excluding specific legal jargon: Analysts welcome the anticipated legislative movement regarding stablecoins, viewing it as a positive catalyst. Coinbase benefits significantly as it derives at least 50% of its revenue from a partnership related to Circle’s USDC stablecoin reserves.

Furthermore, Coinbase is expected to capitalize on its recent investments, like the introduction of a Bitcoin rewards credit card and the planned launch of a stablecoin payment solution (Coinbase Payments), projected to boost user growth and diversify its revenue streams.

Coinbase recently overtook Discover Financial on trading volume to become the S&P 500’s first significant cryptocurrency exchange listing, an achievement seen as positive sentiment for its shares.

Risks Exist

Despite the strong long-term outlook, Coinbase shares trade at a premium relative to other exchange operators and financial data providers.

Conclusion

Even as Bitcoin experiences volatility potentially drawing attention away from Coinbase, the exchange operator continues to demonstrate resilience, powered by its market position and strategic development plans, captivating investor interest despite the inherent complexities of the crypto market interpretation.