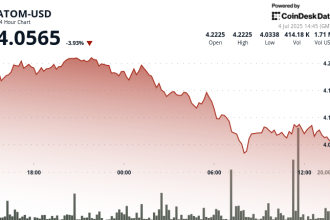

US Stocks and Bitcoin Moderated After Colder-than-Expected CPI Data

US equity markets and cryptocurrency prices were muted Wednesday morning, with earlier gains giving way after May’s Consumer Price Index (CPI) figures cooled slightly below forecasts. The data suggests tariffs imposed during recent trade disputes may not be immediately driving consumer price inflation.

Market Reaction at 2:00 p.m. ET

By 2 p.m. Eastern Time, the S&P 500 Index and the Nasdaq Composite Index each fell 0.3% and 0.5% respectively, erasing initial session gains. Bitcoin trades around $108,800, down 1.1% since early trading.

May CPI Data Overview

Headline CPI increased 0.1% month-over-month and 2.4% year-over-year, slightly lower than anticipated economists’ projections of 0.2% MoM and matching the projected 2.4% YoY. Core CPI, excluding volatile food and energy, rose 0.1% MoM and 2.8% YoY, edging below expectations of 0.3% MoM and 2.9% YoY.

Theories on Cooling CPI Data

Analysts expected tariffs would impact consumer prices in May, but data tells a different story. Proposed reasons include:

- Internal Cost Absorption: Businesses may be covering elevated trade costs rather than passing them on to consumers, particularly as many tariff rates have been temporarily paused.

- Inventory Buffering: Companies stockpiled inventory early this year anticipating tariffs, potentially delaying price escalations.

- Shifts in Trade Flows: Chinese manufacturers increased exports to Southeast Asia (up 15% YoY in May) while shipments to the US fell 34.5%, suggesting trade adjustments are circumventing tariff impacts.

Recent US-China Trade Developments

“We’ve reached a new (old?) preliminary trade deal,” President Trump stated Wednesday.

Commerce Secretary Howard Lutnick reported that officials met in London, concluding with consensus on a “framework” to formally implement talks initiated in Geneva three weeks prior. This morning, President Trump detailed specifics:

- China would remove restrictions on rare earth material exports

- The US planned to revoke recent student visa restrictions and ease export controls on artificial intelligence chips

Implementation requires formal approval from both nations’ leaders.

Focused attention will remain on Thursday’s pending minutes from the Federal Open Market Committee meeting and Friday’s Consumer Confidence report for more inflation and economic momentum data points.