Crypto Market Faces Heavy Liquidations as Prices Plunge

Thursday saw a sharp sell-off in cryptocurrency prices, triggering significant margin liquidations. Trading platform CoinGlass reported $328 million worth of positions liquidated over the past hour, with virtually all being long positions (bets on price increases).

This marks the busiest hour for liquidations so far taking $320 million out of the market alone. Further losses occurred, bringing the total liquidations in the last 24 hours to $713 million, including $650 million from long positions wiped out.

The largest segment of these liquidations involved Bitcoin (BTC), which some reports indicate fell nearly 3% yesterday, pushing its price below $106,200. While BTC has climbed about 5% in the last week, the market appears to be taking profits from recent gains, particularly after surpassing the $110,000 mark earlier this week. A substantial $201 million BTC long position was liquidated.

Ethereum (ETH) price fell more sharply on the day down over 6% to $2,650. Despite climbing nearly 9% recently, overall sentiment seems bearish. A $151 million liquidation report was filed for ETH yesterday.

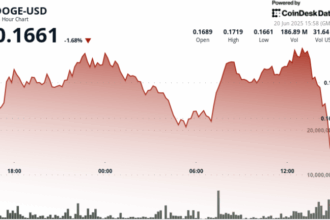

Other major cryptocurrencies recorded notable losses too: Solana dropped nearly 6%, XRP fell over 4%, and Dogecoin (DOGE) plunged 7%. Overall, the crypto market’s value decreased roughly 5% over the past day.

The market downturn stemmed partly from profit-taking following yesterday’s CPI report, which suggested slowing inflation. This led to profit-taking in mainstream assets, an activity that quickly spread across the broader crypto market as losses accelerated.