Empire Newsletter Post

Crypto Market Dynamics Shift Amidst Public Market Surge, Venture Focus Evolves

The convergence of strategic insights from leading venture capital and blockchain research firms highlights ongoing shifts within the cryptocurrency landscape.

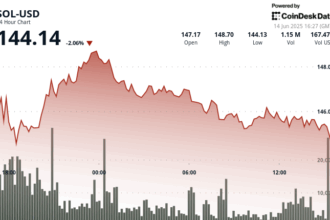

Cryptocurrencies Facing Headwinds, Public Markets Soaring

Following an appearance alongside Selini Capital’s Jordi Alexander and Blockworks Research’s Boccaccio, Dragonfly Capital’s Head of Research, Haseeb Qureshi, described the current crypto market environment as “weird”. He characterized the crypto markets as “staid and rational and reasonable” with comparatively low activity, while simultaneously noting “insane” levels of activity in the broader public markets.

Mr. Qureshi suggested the current disconnect leaves the market in a confusing state:

“No one understands what’s on going. Nobody can explain anything. So it’s a weird moment, and I can’t imagine it’s going to persist for that long, but that’s where we are right now.”

This pervasive energy shift was observed in token demand, citing interest in Circle (formerly Civic) and other “crypto treasury companies” as examples.

VC Capital Allocation – Balancing Equity and Tokens

Despite the market sentiment fluctuation, Qureshi emphasized that cryptocurrency venture capital strategies remain diverse.

“One of the things that people often forget about crypto VCs is that we do both… About half of our investments are into equity and about half of them are into tokens.”

This diversification offers protection, as the apparent strength noted in equity positions co-exists with challenges facing many tokens.

Shift in Project Strategy? Valuing Tokens for Liquidity

According to 6MV founder Mike Dudas, another trend emerging from the current market flux is a strategic repositioning by crypto projects.

“We’re in a real moment of flux where I think it’s a good thing, in that people realize that equity can have value… but you should have a line of sight to some credible token value accrual.”

The interplay between these factors – reduced crypto market participation, VC diversification, and a push for token value – has placed the cryptocurrency space in a “bit of an awkward position,” signalling a period of adaptation rather than permanent stagnation.