In brief

CryptoPunks’, the seminal 2017 NFT collection, floor price reached an almost 16-month high, surpassing $200,000 after spending nearly a year below the $150,000 mark.

A recent sweep involving 45 Punks and rising Ethereum prices contributed to renewed interest in the iconic collection.

Following the sweep, NFT trading volume surged significantly. Trading activity was reported to be the busiest for Ethereum-based NFTs since February of the previous year, with over $50 million in transactions occurring on July 20 and July 21, and CryptoPunks driving over half the market’s volume.

CryptoPunks Floor Price Jumps Amidst Trading Surge

The floor price of the decades-old CryptoPunks collection is ascending once again, lifting into nine-figure dollar territory for the first time in over a year.

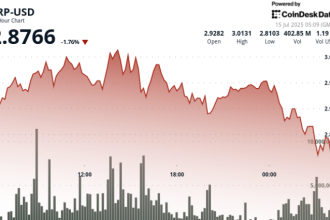

On-chain data confirms the dramatic climb: CryptoPunks’ floor amount has climbed steadily since August 2024, a period during which the floor price doubled in approximately six weeks. Collectors previously considered entry at anywhere between $100,000 to $150,000; those threshold prices no longer represent the minimum a buyer must spend on a high-tier Punk.

Excluding platform fees, the floor price for an 11,198 ETH Punk, currently the cheapest available, translates to roughly $72,763 using an Ethereum average price of $5,208. Considering recent peaks for the cryptocurrency, the floor expressed in dollars now stands at roughly $200,520. This represents a 163% gain since August.

The 45 Punk sweep is considered the inciting incident for this renewed momentum. Speculation identifies the buyer as “oddballwallet,” an alias already linked to the collection.

Further interest in the iconic project may stem not just from the one-time buyer, but from macro economic shifts benefiting dollar-denominated trading on the world’s largest cryptocurrency by market cap. Reduced US dollar strength, driven by volatile macroeconomic conditions, has lifted dollar prices for significant cryptocurrencies.

As Ethereum, the network that houses the Punk collection, recovers its higher valuations, so too does their dollar floor price and overall market cap improve. CoinGecko data shows the larger NFT sector market cap also saw a rise over recent trading weeks.

Additionally, observed preference for certain traits among long-term holders, such as “hoodie” Punks, alongside strategic price-doubling multi-million acquisitions, signals renewed, perhaps more serious, interest despite the sector remaining well below its 2021 heights.

The sustained floor price, particularly its unequivocal movement above $200,000, underscores CryptoPunks’ continued cultural cachet despite their age. The project also remains a formidable asset for financial use cases, clearing nearly $21 million in active loans against Punks on the Gondi lending platform in recent May analysis.