Bit Origin Purchase of 40.5M DOGE May Boost Bullish Case, Targeting $0.29 Rally

China-based crypto miner and pork processor Bit Origin announced the completion of its planned acquisition of 40.5 million Dogecoin (DOGE) for its crypto treasury on Tuesday. The purchase is part of the company’s strategy to become the largest publicly traded Dogecoin holder, facilitated by a $500 million funding round secured through share sales and debt offerings.

Technical Analysis: Price Range-Bound with Potential for Breakout

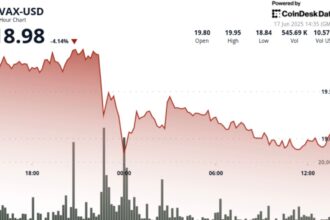

DOGE remains range-bound, trading between $0.14 and $0.29. Following a sell-off from the near-$0.29 resistance, prices retreated towards the 20-day simple moving average at approximately $0.21. Buyers attempted a reversal, presenting opportunities for contest at the previous support-turned-resistance levels at $0.26 and $0.29.

A sustained move above the $0.29 resistance could signal a new bullish trend, potentially targeting the $0.44 mark. Conversely, a break below the $0.21 moving average might confine DOGE to its current range for an extended period, reflecting ongoing indecision among market participants.

Current signs suggest bearish dominance, with the 20-SMA tapering off and negative RSI territory indicating downward pressure. Short-term rallies are likely to face profit-taking near moving averages. Confirmation of strength could come above the $0.29 threshold, mitigating selling pressure and supporting a recovery test towards $0.27 and subsequently $0.29.

This analysis highlights the potential near-term dynamics following Bit Origin’s significant purchase. However, this article does not constitute investment advice. Traders and investors should perform their own due diligence before making decisions.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.