The Crypto Market Opens Higher as Dogecoin Responds to Elon Musk’s Political Ambitions

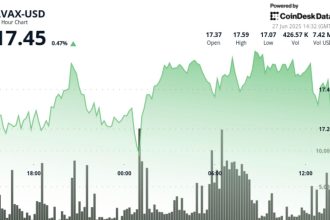

The cryptocurrency markets began the new trading week with gains, led by alternative coins (altcoins) on Monday. Among the top ten by market cap, Dogecoin posted the highest percentage increase, climbing 3.4% by mid-day.

Dogecoin’s surge appears connected to news circulation that Russian-born Tesla CEO and SpaceX founder Elon Musk is creating a new political party, termed “The America Party.” Sources suggest the initiative aims to challenge the traditional Democrat and Republican two-party system in the US.

Musk recently participated in a late-night Twitter session, during which he declared “fiat is hopeless” and suggested his new party would embrace Bitcoin. However, Dogecoin was not specifically mentioned.

A History of Connection: Elon Musk and Dogecoin

Musk has maintained a long-standing, albeit often complicated, relationship with the crypto world, particularly Dogecoin. Dogecoin gained prominence, in part, from internet memes and was notably associated with Musk.

Recall that last year, Musk spearheaded the formation of the “Department of Government Efficiency.” Its acronym, DOGE, is the ticker symbol for Dogecoin.

Perhaps this week’s market movement reflects trader anticipation that Dogecoin’s role – or at least press coverage involving Musk – could become central to Musk’s political party.

Solana Gains Following Staking ETF Launch

Other significant gainers among the major altcoins were Solana and Ethereum. Solana advanced by 3.1%, while the platform underpinning many smart contracts, Ethereum, rose 1.9%.

A notable development came on Wednesday with the debut of the first U.S.-listed exchange-traded fund (ETF) investing in Solana. According to a spokesperson for REX Shares and Osprey Funds, the fund attracted $12 million in new money on its first day of trading.

Volume in $SSK (referring to the ETF) is now $20 million, a strong start for a new launch. For reference, $SOLZ ($1 million day one) was considered strong.

– Eric Balchunas (@EricBalchunas), July 2, 2025

Bloomberg analyst Eric Balchunas highlighted the fund’s “healthy start to trading,” noting it ranked within the top 1% of new financial products by inflows. However, preventing a major hurdle remains the potential approval of SEC-proposed spot price tracking Bitcoin and other altcoin ETFs, which could draw substantial institutional capital.

At the current benchmark, Bitcoin shows considerably weaker performance compared to most altcoins, rising only 0.5% over the past 24 hours.