Dogecoin tumbled as much as 7.5% in 24 hours, sliding from $0.176 to $0.164 as markets continue to react to rising geopolitical conflict in the Middle East and hawkish central bank policy.

News Background

- Tensions between Israel and Iran escalated over the weekend, prompting a swift risk-off reaction in global markets. Crypto was no exception, with DOGE shedding nearly 8% before stabilizing above a key technical floor.

- Meanwhile, the Federal Reserve is widely expected to keep interest rates steady at 4.25%–4.50% and continuing to unwind its balance sheet.

- These macroeconomic headwinds have weighed heavily on altcoins, especially high-beta assets like dogecoin.

- Despite this, DOGE found support as buying activity returned near the $0.164 level, forming a potential double bottom pattern that some analysts view as a base for consolidation.

- With volatility cooling and volume declining, the market appears to be waiting for a clearer signal before its next directional move.

Price Action

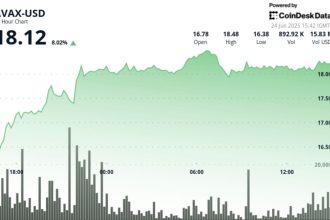

The sharpest sell-off came during the 15:00–16:00 window, where DOGE saw nearly 700 million units traded as price dropped below key support. Buyers stepped in at $0.164, lifting DOGE into a range between $0.168 and $0.171.

Late-session trading showed price stabilizing above $0.170, with a bullish push at 01:21 sending DOGE to $0.1719 before fading. Price action since has traced a descending triangle with lower highs forming against flat support.

Technical Analysis Recap

- DOGE fell from $0.176 to $0.164, a 6.7% drop, before finding support.

- Most intense selling hit during 15:00–16:00 with volume nearing 700M.

- Support formed at $0.164, followed by consolidation between $0.168–$0.171.

- Bullish push at 01:21 hit $0.1719 but was quickly rejected.

- Volume declined sharply in the final hours, with most candles under 3M.

- Descending triangle pattern formed, with resistance at $0.171 and support at $0.1705.