Altcoin Surge Follows XRP’s All-Time High

In a significant market shift, Ethereum Classic (ETC), Litecoin (LTC), and Bitcoin Cash (BCH) have experienced notable price increases following XRP’s milestone achievement.

On Friday, XRP reached a new all-time high ($3.65) after a seven-year drought, propelling several older cryptocurrencies higher. Current trends suggest an early-stage “altcoin season” might be underway, albeit selective.

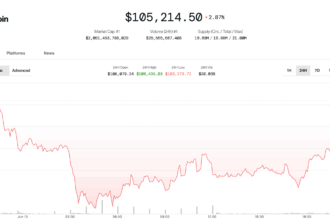

Today in Crypto Markets

- Ethereum Classic (+20.3% in 24 hours)

- Litecoin (+9% daily gain)

- Bitcoin Cash (+6.4% daily)

- XRP Reaches Seven-Year ATH

Expert Analysis

Akshat Vaidya, CIO at venture capital firm Maelstrom, told Decrypt that the rally of “old-school” altcoins signals an early phase of an altcoin season potentialized by Bitcoin’s recent new all-time high. He noted:

“We’re seeing early signals of an ‘altcoin season’, but it’s not fully underway yet… Old coins [are] attracting capital first. You’ll have to wait for a true altseason to see newer coins pump.”

Vaidya pointed out that while Bitcoin dominance (60+) remains high, the flow of capital “clearly shows that momentum is building” towards altcoins, describing the potential shift as a potential “post-BTC all-time high altseason.”

Context: ETC, LTC, BCH

Analysts are watching the performance of these “retro altcoins.”

**Ethereum Classic**: Gained 20.3% but remains down approximately 85% from its 2021 peak. ETC resulted from a hard fork in 2016 following the DAO hack.

**Litecoin**: Hit a four-month high ($110.12), up 9% daily, following its creation in 2011 by Charlie Lee. It aimed to be faster than Bitcoin.

**Bitcoin Cash**: Climbed 6.4% daily after its origin in 2017 from a Bitcoin hard fork over differing block size opinions. Note: It has undergone further splits.

Broader Context

XRP’s breakout coincided with ongoing regulatory proceedings, albeit ones appearing to lose steam amidst the price action.

Meanwhile, other alts like Uniswap (+17.5%), Dogecoin (+11.3%), and Hedera (+7.6%) also posted gains. Positive signals from the U.S., including policy advocacy and potential stablecoin legislative progress, contribute to overall crypto market enthusiasm, as per research firm Derive.