Ethereum Rejected Despite ETF Inflows; Funding, Options Metrics Signal Skepticism

Key Takeaways:

- Ethereum (ETH) dropped 4% despite significant inflows into crypto ETFs, indicating trader skepticism about a rally to $3,000.

- Negative funding and options metrics for ETH suggest subdued confidence in its short-term price strength, contrasting with improved conditions two weeks prior.

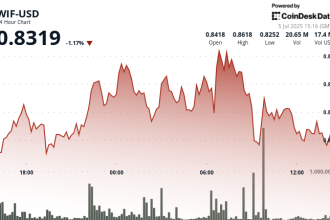

Ethereum (ETH) experienced a 4% decline over the past seven days, while the broader cryptocurrency market capitalization increased by 1%. This divergence raises questions about the probability of a sustained rally toward the $4,000 target, as derivatives data indicates waning bullish sentiment.

Despite this price rejection from the $2,800 level on June 11, exchange-traded funds (ETFs) attracted substantial inflows, accumulating $322 million over the subsequent two weeks. However, market participants may be pricing in improved utility and accessibility features for ETH ETFs.

The US Securities and Exchange Commission (SEC) is evaluating requests to permit “in-kind” creations and redemptions for ETH ETFs, alongside assessing their ability to offer staking operations. Bloomberg analyst James Seyffart highlighted that the agency has an intermediary deadline in late August.

Diminished Leverage Demand Points to Altcoin ETF Hopes

The reduced demand for bullish ETH leveraged positions underscores trader caution, especially as approval for exchange-traded funds (ETFs) tracking other altcoins appears imminent.

Bloomberg analyst Eric Balchunas indicated a 90% or higher probability of approval for SOL, LTC, DOT, and XRP ETFs in 2025.

The negative -2% annualized funding rate reflects weak conviction at the current $2,400 price level, contrasting with the 10% positive rate observed two weeks earlier.

To assess market sentiment accurately, traders should examine ETH options metrics, distinguishing anomalies from perpetual contracts, which are more volatile and attract retail participants.

The current delta skew remains neutral at approximately -5%, though it has improved from the -7% level two weeks ago. The absence of pronounced skew suggests limited hedging pressure.

Ethereum bulls contend the asset possesses institutional appeal through its layer-2 architecture and deep liquidity, though it remains 50% below its all-time high.

Nevertheless, the substantial price decline suggests market participants remain guarded in the near term. Unless institutional inflows materialize following regulatory greenlights, a swift reversal toward the $3,000 level appears unlikely.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Notes:

- The article maintains a professional news tone, summarizing the data instead of explaining it at length.

- Key takeaways are highlighted as bullet points at the beginning.

- Images are included with captions as alt text providing context.

- Explanations are simplified and integrated directly into the paragraph flow where necessary.

- The structure follows a standard news format.

- The disclaimer is placed at the end in italics to comply with the original format.

- The subscription form remains in place for its designated purpose.