Ethereum (ETH) Faces Rally Test Amid Institutional Inflows

Ethereum (ETH) is currently trading within a range, but sustained buying activity through exchange-traded products (ETPs) could signal an impending breakout.

Key Point:

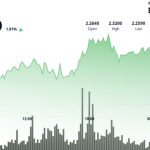

- Ethereum bulls must secure a daily close above $2,635 to initiate a potential rally toward resistance near $2,738.

According to CoinShares data, ETPs tracking Ether accumulated $225 million during the past trading week, marking 11 consecutive weeks of inflows.

Ethereum’s price has held steady above the crucial 20-day exponential moving average (EMA) at $2,507, suggesting continued trader conviction despite the prevailing sideways movement.

Analysts suggest a successful assault on the overhead $2,635 barrier is necessary to unlock upward momentum. Failure to breach this level could see sellers test a significant resistance zone between $2,738 and $2,879.

On the downside, a break and close below the 20-day EMA of $2,507 could indicate a shift in sentiment, exposing robust support around $2,323. Accumulation is anticipated in the $2,111-$2,323 range.

The 4-hour ETH/USDT chart presents a symmetrical triangle pattern, reflecting a battle between buying and selling pressure. A decisive close above the range on lighter timeframes from the triangle low would signal bearish control broken, potentially catapulting the price toward the pattern resistance target near $2,751.

Conversely, a breakdown and sustained trade below the triangle formation would herald a shift in momentum, pointing towards a potential descent to the bullish objective, excluding the network’s current range, at $2,364.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.