Ethereum Faces Volatility Amid Institutional ETF Flows, Bullish Outlook Persists

Ethereum (ETH) experienced significant price volatility recently, dipping to a 15% low before hovering near $2,600. However, strong institutional buying signals suggest continued support despite short-term fluctuations.

- Rising spot ETH ETF inflows and institutional buying indicate strong interest, supporting a bullish outlook.

- A potential dip to $2,100-2,200 could provide strategic entry points.

- Institutional buildout on Ethereum could trigger a rally by year-end.

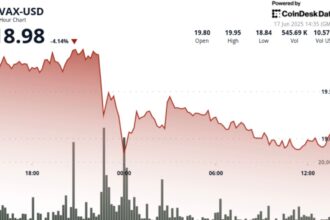

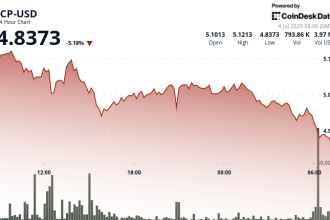

Price Action and Technical Patterns

ETH recently reached a 15-week high of $2,879 before dropping to $2,433 on Friday, a roughly 15% correction. The cryptocurrency is currently consolidating just below $2,600.

A weekly chart shows ETH forming an ascending channel pattern, characterized by higher highs and higher lows within parallel upward-sloping lines. This pattern indicates a steadying uptrend, though it also suggests potential downside if the crypto falls below the support range at $2,100-$2,200.

Historical Context and Q3 Outlook

Ethereum’s historical Q3 performance adds context to current market expectations. The cryptocurrency has averaged just 0.88% in Q3 returns this year, while the previous two quarters saw declines of 13.64% and 24.19%, respectively.

The summer vacation season typically reduces market trading volume, which could contribute to Ethereum’s consolidation and potential drop toward the $2,100-$2,200 support level.

Bullish Catalysts and Institutional Interest

Ethereum stands to benefit significantly from increasing institutional participation. Spot ETH ETF flows are rising rapidly, with over 154,000 ETH in new inflows this week alone, five times the weekly average.

“This week alone, they’ve seen 154K ETH in inflows – 5x higher than their recent weekly average. For context: the biggest single-day ETH inflow this month was 77K ETH on June 11th.”

Besides broad ETF inflows, BlackRock’s investment in Ethereum through its iShares Ethereum Trust (ETHA) further demonstrates institutional commitment. Recent purchases have increased BlackRock’s holdings to 1.51 million ETH, valued at approximately $3.87 billion.

Data from Token Terminal indicates billions are flowing into Ethereum as financial incumbents tokenize assets. Tokenized assets under management surged past $5 billion, with major players like BlackRock driving this trend.

Technical Analysis and Future Outlook

The $2,100-$2,200 range has historically served as support since late 2023, acting as a multi-month magnet for buying pressure. A price near this level could present a compelling entry opportunity for investors.

Combined with historical strength in Q4 and ongoing year-end investment strategies, Ethereum appears well-positioned for a potential breakout by late 2025. The cryptocurrency’s unique contractual advantage in the tokenization space further strengthens its position as a foundational technology for the broader Web3 ecosystem.

Conclusion

Despite recent volatility and challenging quarterly performance, Ethereum maintains strong institutional backing. The confluence of rising ETF inflows, tokenization momentum, and potential year-end buying suggests a bullish longer-term trajectory.

This article does not contain investment advice or recommendations. Every investment involves risk, and readers should conduct their own research when making decisions.