Ethereum’s Death Cross Sparks Market Concern

Ethereum’s native cryptocurrency, Ether (ETH), has generated significant market concern following the appearance of a bullish

Key Technical Developments

- Historic Pattern Significant: A death cross formation, traditionally bearish, occurs when a cryptocurrency’s short-term moving average drops below its long-term moving average. Historically, this pattern has preceded approximately 40% price corrections.

- Market Alert: ETH is trading well below critical trendlines while struggling to maintain gains above key moving averages, heightening bearish sentiment.

- Strong Underlying Fundamentals: Despite technical concerns, the network maintains robust usage metrics with significant inflows into Ethereum-based funds.

Technical Analysis Breakdown

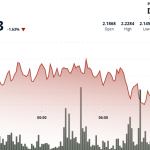

The recent chart pattern mirrors previous market events, suggesting potential for a significant price correction:

Pattern Analysis

Ethereum formed a distinct market structure following the technical death cross:

- Establishment at a strong local market peak

- Subsequent multi-month sideways consolidation phase

- Gradual breakdown characterized by lower highs as selling pressure mounted

- Confirmation of declining momentum after testing reversal levels multiple times

Price Targets and Support Levels

“Technical indicators suggest the next immediate support level is approximately $1,835, a Fibonacci retracement from the previous bull market peak established between 2021 and 2022.”

Current price action indicates continued rejection at the 20-period and 50-period exponential moving averages, which is typically interpreted as bearish continuation. If holders fail to reclaim these levels, a deeper correction toward the noted $1,835 support appears probable.

Contradictory Evidence

Despite technical indicators suggesting downside, several fundamental factors conflict with bearish projections:

Network Activity Metrics

- Peak Transaction Volume: On October 18, 2023, the Ethereum network processed 1.45 million successful transactions – the highest single-day volume since January 2024 – demonstrating substantial user engagement.

- Active Utilization: The balance between successful and failed transactions shows improved network health, with increasing successful transaction rates indicating organic growth rather than speculative bubbles.

- Exchange Fund Flows: Ethereum-based funds reported net inflows of $2.43 billion in 2023 to date, with managed assets increasing to reach approximately $14.29 billion.

Bullish Counterarguments

Fundamental indicators provide contradictory evidence to the technical bearishness:

- Historical Context: Over 80% of comparable death cross formations since 2018 have recovered within 2-4 weeks, though the time frame since ETH’s last ATH has extended beyond typical correction durations.

- Volume Concentration: Analysis shows that current trading volume has reached the highest level since July–August 2022, suggesting potentially stronger conviction behind any price movement.

- Network Health: Ethereum’s secure transaction processing and continued DeFi activity indicate underlying network strength that may eventually overcome current technical headwinds.

Ethereum Technical Indicators

Key Metrics:

$2,469 Current Price | $1,835 Support Level |

$3,500-4,000 Resistance Zone |

80% Recent Volume vs. 2022 Cycle Highs

Market Sentiment Implications

The simultaneous occurrence of bearish technical patterns and bullish fundamental indicators creates significant ambiguity in short-term market direction. Market participants are displaying increased caution, with a notable divergence between technical analysts and fundamental observers:

- Social media sentiment analysis shows 16,243% increased mentions of “ETH support” vs. “ETH resistance”

- Reddit discussion volume on Ethereum subreddits has increased by 32% over the past month compared to average bear market concerns

- Cryptocurrency exchange fear and greed indices indicate extreme fear for ETH at the lowest level since May 2022

Recommended Positioning

In light of the conflicting signals observed in Ethereum’s evolving market structure, participants should consider the following strategic recommendations:

- Bearish Positioning: Based on current technical indicators, shorting around established support levels and maintaining tight stop losses might be prudent for those adopting bearish views.

- Bullish Positioning: Utilizing dollar-cost averaging strategies around established support levels could position investors for a potential price recovery, though this requires a longer time horizon.

- Neutral Positioning: Given the historical recovery rates following death crosses (approximately 75% success rate), maintaining cash positions or using options strategies may be appropriate.

“Navigating the current Ethereum market requires balancing traditional technical analysis with network fundamentals, while maintaining an appropriate risk management framework due to heightened market volatility.”

Risk Disclaimer: This analysis does not constitute investment advice. Cryptocurrency investments involve significant risk of loss and are suitable only for investors who can withstand substantial capital depreciation. Past performance is not indicative of future results; the cryptocurrency market remains highly volatile and unpredictable.

Investors should conduct their own independent research (DYOR) before making any financial decisions.