Ethereum Rises 3% Amid Market Optimism

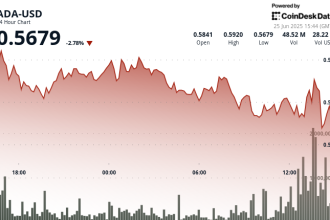

Ethereum has defied Bitcoin’s recent pullback, rising nearly 3% this week to reach $3,960, the closest it has come to the $4,000 psychological barrier since March 2024 amid signals of heightened institutional interest.

Key Drivers Behind the Rally

- Recent inflows into U.S. spot Ethereum ETFs have reached $5.51 billion over 18 consecutive days.

- Analysts cite potential approval for staking in Ethereum ETFs as a key catalyst, suggesting a regulatory shift from previous SEC concerns.

- Increasing treasury purchases of Ethereum are also contributing to the second-largest cryptocurrency’s upward trajectory.

Despite the prevailing optimism, the market contends with short-term technical resistances. According to Republic Technologies CEO Daniel Liu, a “range-bound movement” could continue until clearer catalysts emerge.

Bullish forecasters, including Derive Research head Sean Dawson, predict Ethereum could reach new all-time highs as soon as the holiday season, potentially breaching the $5,000 threshold.

The path to Ethereum’s next milestone could be influenced by several factors:

- Market sentiment driven by U.S. tech stocks and AI sector valuations

- Federal Reserve policy decisions

- Potential regulatory developments regarding spot Ethereum ETF staking

The cryptocurrency will be under close watch this week as market participants await the Fed’s interest rate decision and seek signals from sentiment indicators that could validate the current risk-on environment.