Ethereum ETFs Dominate Crypto Market as Inflows Reach Record $1.8 Billion

Week-long inflows into nine spot Ethereum exchange-traded funds surged past $1.8 billion, significantly outpacing the $70 million recorded by their Bitcoin counterparts, marking a notable shift in investor sentiment.

For at least a week, spot Ethereum ETFs have generated more investor funds than Bitcoin ETFs. According to asset manager Farside Investors, these nine funds saw net inflows exceeding $1.8 billion during the period, extending a 16-day positive streak. Assets under management for ETH ETFs, the second-largest cryptocurrency, reached roughly $10.6 billion.

In stark contrast, the 12 Bitcoin ETFs reported only $70 million in net inflows over the same timeframe. Notably, three of the five reporting days saw net outflows for Bitcoin ETFs.

The increased interest in Ethereum is intertwined with the rise of Ethereum treasury companies and the growing support for stablecoins originating from the Ethereum ecosystem. This trend appears to have accelerated as the “GENIUS Act,” a pivotal stablecoin bill later signed into law by President Donald Trump, was nearing passage.

Experts suggest institutional investors, many who already hold Bitcoin ETFs, are increasingly diversifying. “Ethereum is the second-largest digital asset, and the only other one available in [spot] ETF format—making it very easy to choose,” explained Ric Edelman, founder of the Digital Assets Council of Financial Professionals.

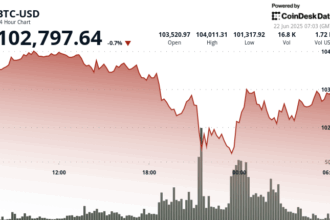

Ethereum’s price has also seen significant gains, reaching a seven-month high before briefly pulling back.

Leonardo Vianello, BlackRock’s ETF portfolio manager, told Decrypt the ETHA ETF performance was the third-fastest fund in the industry’s history to reach $10 billion in assets. Juan Leon, Investment Strategist at Bitwise Asset Management, noted this week’s performance caps a month during which ETF inflows for Ethereum have consistently outperformed those for Bitcoin.

Despite Ethanalysts like Leon believing Bitcoin ETFs could see renewed interest from major financial platforms later this year, they also agree that ETH ETFs are currently a powerful trend. “Irrespective of the absolute numbers, from the point of view of how big one asset is in relation to the other, ETH will continue to punch above its weight,” Leon stated.