Ethereum Whales Accumulate Fastest Since 2022: Indicators Point to Potential Price Rally

Ethereum wallets holding significant amounts have increased their holdings by 9.31%, a buildup far exceeding the previous large rally in mid-2022 according to analytics provider Glassnode. The cryptocurrency is currently consolidating and forms a classic chart pattern suggesting a potential breakout towards higher prices by August.

Mega Whale Holdings Reach 36-Month High

According to Glassnode data cited in the report, Ethereum wallets holding at least 10,000 Ether (ETH) have increased their supply since hitting a record low below 37.6 million ETH in October. As of Monday, this total surpassed 41.06 million ETH, marking a 9.31% increase.

This rate of accumulation is nearly double the pace seen during the approximately 95% price increase that preceded the 2022 market peak.

A similar accumulation trend occurred before the bear-to-bull market shift from late 2020 to early 2021, when whale accumulation coincided with ETH’s journey from around $460 to $1,220.

Notably, these accumulation phases precede broader market recognition and upward price movement. ETH’s recent sideways price action suggests the current buildup is still occurring quietly, undetected by the wider market.

Simultaneously, the re-emergence of significant whale supply coincides with growing inflows into Ethereum-focused investment funds, including ETFs. This represents the strongest and most sustained return to multi-million ether holdings since the long-term downtrend began in June 2020.

Bull Pennant Pattern Points to $3,400 Target

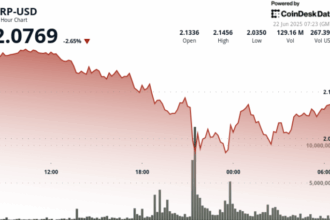

Ethereum is trading within a textbook bull pennant formation on the daily chart—a classic continuation pattern signaling accumulation ahead of the next significant move.

Consolidation within the pennant has tested both its upper and lower boundaries, with both breakouts and breakdowns previously failing, indicating strong player interest on both sides of the current price range and reinforcing the potential for decisive movement.

According to the technical analysis, a clear break above the pennant’s apex could propel ETH prices toward a $3,400 target by August, with some indicators suggesting an even larger potential if current trends continue.

Glassnode data also highlights the $2,500–$2,536 price range as a crucial accumulation zone. Over 3.45 million ETH have cost bases recorded within this specific range, signifying a strong concentration of long-term holders.

Strong buying activity centered near current consolidation levels underscores that a successful breakout from the bull pennant formation would represent a substantial validation of the existing accumulation phase and position ETH for further gains.