Ethereum Momentum Strengthens: Open Interest at Record High, Analysts Revisit $30K Targets

Key Developments

- Ethereum futures open interest hits $46.58 billion, the highest level ever recorded

- ETH price gains 6% in 24 hours, reaching its highest point in four months

- Analysts suggest potential targets of $30,000 with near-term $4,000 barrier

- Network fees surge 109%, adding to ETH’s scarce supply

- Ethereum may outperform Bitcoin in 2023’s final half, according to some market participants

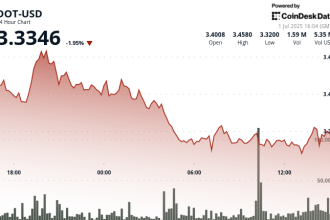

Ethereum (ETH) prices saw a significant surge, closing Wednesday at $3,170 amid strong market sentiment. The cryptocurrency gained 6% over the last 24 hours, outperforming the broader cryptocurrency market which increased by only 1.8% during the same period.

Simultaneously, Ether futures’ open interest climbed to a record high of $46.58 billion, indicating increased market participation and new capital flowing into ETH futures contracts. Data shows this represents a 64% increase since June 22.

Ethereum Open Interest Reaches All-Time High

The $46.58 billion open interest marks the highest level of Ether futures contracts ever recorded, signaling growing institutional confidence in the cryptocurrency. This development comes weeks after ETH traded around $4,000 in December 2022, with open interest at $31.5 billion.

Aggregate open interest growth has been substantial, with a 31% increase over the past seven days alone. This rapid expansion demonstrates the crypto market’s renewed enthusiasm for Ethereum and suggests increasing demand for leveraged positions on the asset, which could fuel further price appreciation.

Network activity also supports ETH’s bullish trajectory, with Ethereum network fees surging 109% to $12.40 million in the last week according to Nansen data.

Higher network fees contribute to Ethereum’s burn mechanism, reducing circulating supply as more ETH is removed from circulation through transaction validation fees.

Analysts Revisit Ambitious Price Targets

Market participants are increasingly optimistic about Ethereum’s short-to-medium term prospects. The current price action has maintained levels above $3,000 for six consecutive days, with many analysts viewing the $3,150–$3,200 zone as a strong potential support structure.

“I’ve completely readjusted my expectations for $ETH this run to top out between $15K-$30K.”

According to DeFi Dad, potential upside targets could run as high as $18,000 from current levels, representing significant gains from a token that recently traded near $1,600 on April 17.

“Ethereum could outperform Bitcoin in the second half of the year, reaching $6,000 before 2026… the said forecast is extremely conservative”

Cryptocurrency investor John K. Davies suggests Ethereum could outperform Bitcoin in 2023’s final half, potentially exceeding $10,000 by second quarter 2026.

“I am buying and holding ETH, believing we can run at minimum to $15K-$18K… 5-6x from here”

Technical analysis from Crypto GEMs suggests Ether could follow a similar trajectory to its 2016-2017 market cycle from April’s low, potentially increasing 330% from current levels.

“ETHEREUM IS BREAKING ABOVE THIS MASSIVE RESISTANCE!!! $4,000 IS IMMINENT! WE ARE ABOUT TO GET RICH!”

Analysts connect $4,000 with important historical cycle data points and see this level as a critical psychological barrier to higher prices.

Strong Institutional Demand

Institutional demand through spot Ethereum ETFs and ETH treasury companies remains strong, reinforcing bullish sentiment for the cryptocurrency’s near-term prospects.

Ethereum appears positioned to leverage growing institutional adoption alongside increasing network usage to sustain its current price momentum.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.