All at once or one by one — that’s the question facing the Securities and Exchange Commission as it considers how to handle Ethereum exchange-traded fund staking amendments.

BlackRock’s move this week to add staking to its iShares Ethereum Trust has reignited debate over the agency’s bulk approval process.

While Franklin Templeton, Grayscale, 21Shares, and Fidelity filed similar requests months ago, BlackRock’s proposal arrived late, with a final decision not due until April 2026.

Despite that timeline, analysts expect the SEC to act sooner — possibly as early as Q4 — and issue a single decision for all applicants. That outcome would align with how the agency approved spot Bitcoin and Ethereum ETFs last year.

The race

Not all issuers are in support of that approach.

In a letter submitted last month, VanEck, 21Shares, and Canary Capital urged the SEC to consider a first-in, first-out process instead.

Bulk approvals, they argued, “diminish investor choice, compromise market efficiency, and fundamentally undermine the commission’s mission.”

Crypto researcher Noelle Acheson highlighted the competitive concerns at play.

“The bulk decision policy makes it harder for the little guy to offer something new,” she wrote in a Saturday newsletter, describing how larger firms can wait on the sidelines and still dominate once approvals are secured.

BlackRock, on the other hand, is expected to argue that bulk approval promotes market consistency and gives investors more immediate access to products from trusted providers.

Either way, Bloomberg ETF analyst James Seyffart expects a decision sooner rather than later.

“I doubt it’ll take until April,” he wrote on X on Friday. “Staking will likely be approved by at least Q4 2025.”

Ethereum funds outperforming

The SEC’s decision may carry weight, especially as Ethereum ETFs are gathering momentum.

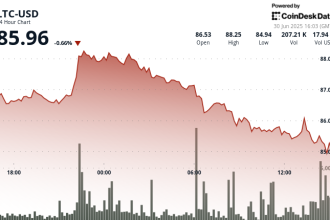

Ether funds recorded $720 million in inflows last Wednesday — their largest daily total ever — and nearly $2.2 billion has poured in the past five trading days.

Bitcoin lost 0.2% in value over the past 24 hours and is trading at $118,135.Ethereum gained 4.1% in the same period to $3,710.Gavin Wood’s Polkadot revamp features a stablecoin, belt-tightening, and a ‘womb room’ — DL NewsGENIUS Act Passes: Who Are the Winners, Losers, and What Comes Next? — UnchainedAre you ready for Appcoin season? — Milk RoadRobert Leshner takes investors on ‘crazy ride’ that ends with a new crypto treasury company and heavy losses — DL News