SharpLink Gaming Faces 20% Stock Drop Amid Ethereum Strategy Shift

SharpLink Gaming (SBET) experienced a significant drop of over 20% in its stock price on Friday, closing near an all-time low. The sharp decline followed a regulatory filing submitted Thursday seeking to substantially increase its planned common stock sales.

In its Thursday filing with the U.S. Securities and Exchange Commission (SEC), SharpLink announced it would boost its stock sale goal from $1 billion to $6 billion. As stated: “We are increasing the total amount of common stock that may be sold under the sales agreement to $6 billion…”

This substantial move is part of the company’s ongoing strategy to build its Ethereum treasury. Arkham Intelligence data confirms SharpLink has significantly increased its ETH holdings, reaching approximately $1.3 billion in value after Thursday’s purchases. Company officials have aimed to position SharpLink as the world’s largest corporate accumulator of Ethereum.

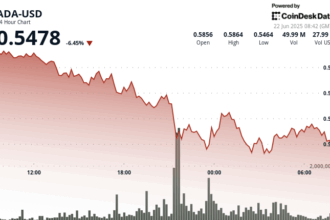

The stock reacted negatively to the filing, resulting in Friday’s steep drop, despite the company posting a 16% gain for most of the week. It highlights the volatility surrounding investors’ reactions to market movements tied to the evolving crypto treasury strategy.

SharpLink’s stock has seen substantial gains since late May, when it initiated its pivot from affiliate marketing towards Ethereum accumulation through a large private placement. In the past several months, SBET’s share price has surged more than 330%.

While junior cryptocurrency markets experience fluctuation, the trend observed by several firms, including MicroStrategy (now focused on Bitcoin accumulation) and others like Bit Digital (BTBT) and BitMine Immersion, suggests a growing pattern in corporate treasury diversification. SharpLink appears poised to compete for this emerging title.