Bitcoin’s Enduring Dominance in the Crypto Market

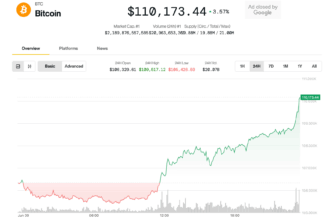

Eight years ago, during a pivotal moment in Bitcoin’s trajectory, one cryptocurrency came closest to challenging its supremacy.

The Near-Capture: Ethereum in June 2017

In June 2017, as Bitcoin surged towards a potential $20,000 peak by year-end:

- Altcoins displayed extreme volatility, with some gaining 250% and others losing 50%.

- Ethereum’s market dominance reached an unprecedented 17% of the total crypto market capitalization ($36.8 billion vs. Bitcoin’s $44.3 billion).

- This near-equivalence occurred amidst a boom of Initial Coin Offerings (ICOs), largely fueled by Ethereum-based projects, with $7 billion supposedly invested—a sum four times larger than all crypto equity investments during the period.

An Unfulfilled Promise

The “Flippening”—the hypothetical moment when Ethereum surpasses Bitcoin—loomed large but was ultimately derailed.

Both Bitcoin and Ethereum plummeted 60% in the following month, halting Ethereum’s climb. While Bitcoin subsequently rallied 10x, Ether only managed a 9x surge, failing to reclaim its 17% market share.

Ethereum remains the closest challenger to Bitcoin’s dominance historically, but even its peak was surpassed by Litecoin and Ripple in earlier years, only for Bitcoin’s dominance to solidify once more.

The Current Reality

Today, Bitcoin continues to dominate the crypto market, holding nearly two-thirds of the total market value. Its position as the benchmark asset in the cryptocurrency space remains unchallenged.