Key takeaways:

- An Ethereum whale opened a $11.15M leveraged long position at an ETH entry price of $2,758.35, following a price surge above $2,850.

- ETH’s price breakout above $2,850 triggered significant gains on the whale’s position, creating an $366,600 unrealized profit.

- Ethereum’s 25-delta options skew plunged from -2.4% to -7.0% (1-week) and -5.6% to -6.1% (1-month), signaling heightened short-term bullishness.

A whale operator established a $11.15M long position on Ethereum ETH, employing 25x leverage, on June 10, just as the cryptocurrency broke out of a bull flag pattern.

$11.15M Leveraged ETH Long Position Signals Strong Bullish Sentiment

On June 10, a substantial Ethereum whale initiated a substantial long position. Measured at $11.15 million with 25x leverage, this equates to a bet of 4,000 ETH purchased at an entry price of $2,758.35.

The whale’s position valuations have significantly improved since initiation. ETH’s subsequent price increase to near $2,850 resulted in an estimated $366,600 unrealized profit for the trader, presenting a liquidation risk level at $2,466.

Ethereum Options Skew Shifts Pronouncedly Negative

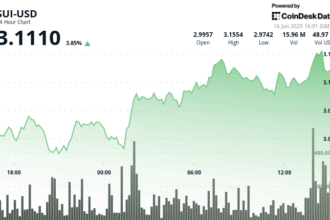

Ethereum’s derivatives market exhibited pronounced shifts in sentiment over the preceding 48 hours.

Glassnode data indicates the 25-delta skew—a gauge differentiating call prices against put prices—has experienced sharp reductions. The 1-week skew fell from -2.4% to -7.0%, while the 1-month skew decreased from -5.6% to -6.1% in the same period.

This deepening negative skew strongly suggests increased demand for short-dated call options, underscoring trader conviction in imminent near-term price appreciation.

Ethereum Bull Flag Breakout Suggests Potential 30% Rally Towards $3,670

Ethereum’s price structure has completed a notable technical pattern. On June 9, ETH price broke decisively above a suspected bull flag pattern, subsequently maintaining upward momentum alongside elevated trading volumes.

This break and consolidation in volume align with trader thesis expecting the cryptocurrency to target, by month-end, the former bull flag resistance level around $3,670, representing a potential 30% increase from current levels.

Disclaimer: This article does not constitute investment advice or recommendations. Every investment and trading move involves risk, and readers are advised to conduct their own research.