Ethereum Whale Accumulates $39 Million Amid Middle East Tensions

Key Takeaways

- An Ethereum whale’s wallet executed a major purchase of 9,400 ETH (~$39 million) on June 22, taking its total holdings to approximately $330 million.

- Ethereum mega-whales increased their net positions by over 116,000 ETH (~$265 million) on June 21, displaying consistent buy-the-dip sentiment during market corrections.

- Technical indicators suggest ETH may test the $2,735 resistance level if it breaches a key ascending trendline, indicating a potential 25% upside from near $2,155 levels.

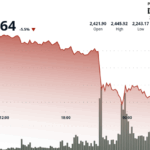

A high net worth Ethereum trader has accumulated tens of millions of dollars worth of Ether (ETH), defying a broader market downturn triggered by escalating Middle East tensions and fresh signs of risk aversion.

Ether’s sharp drop fails to terrify whales

Despite Ether suffering a nearly 13% drop to $2,155 during the sell-off, the wallet address 0x7355…213 actively acquired 9,400 ETH across two significant purchases initiated on June 22.

The whale security deployed newly purchased ETH into Lido’s liquid staking protocol even as Ether underperformed the broader market, falling significantly worse than Bitcoin, which lost approximately 4.7% in the same period.

Source: Cointelegraph analysis

The decision to deploy staked ETH suggests confidence in Ethereum’s network despite geopolitical market jitters from the ongoing Israel-Iran conflict.

Ethereum mega-whales holding 10,000 ETH or more exhibited increased buying pressure leading up to and including the day following the US military strike on Iran.

Ethereum is eyeing a 25% bounce

According to market analyst Sensei, Ether is currently holding a key ascending trendline that could lead to a significant short-term bounce.

The current technical setup bears resemblance to Ether’s dramatic low-to-high rebound exceeding 55% earlier this cycle.

“If the pattern plays out, ETH could rebound toward the $2,735 resistance level,” Sensei noted. This represents approximately a 25% increase from current near-$2,155 prices.

Source: TradingView (Sensei)

The timing of these whale purchases suggests participants are often positioned to profit from sharp market corrections, capitalizing on volatility.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.