eToro Plans Ethereum-Based Tokenized Stocks With 24/7 Trading

by Financial Analyst – December 19, 2023

In Brief

- eToro will introduce tokenized stocks on Ethereum.

- The feature enables continuous 24-hour, 5-day-a-week trading.

- Initial offerings will include 100 popular US stocks and ETFs.

Online brokerage giant eToro announced Tuesday plans to launch tokenized stocks on the Ethereum blockchain. The innovative feature allows investors to trade assets continuously, breaking from traditional market hours.

This initiative enables trading through ERC-20 tokens, with initial implementation focusing on 100 of the most actively traded US-listed equities and exchange-traded funds. The platform has not yet specified an official launch date.

“We are part of the largest wealth transfer in human history, from older generations to younger investors,” stated CEO Yoni Assia during a webinar announcement. He emphasized that next-generation investors are increasingly exploring capital markets through new technological paradigms.

Market Context

eToro joins a growing segment of financial services firms expanding blockchain capabilities amid increasing tokenization interest. The relationship between conventional finance and cryptocurrency is evolving rapidly.

This announcement follows similar moves by major financial institutions, including BlackRock’s March unveiling of a USD Institutional Digital Liquidity Fund operating on Ethereum. CEO Larry Fink’s previously skeptical stance toward cryptocurrency has notably shifted.

The broader tokenization market has shown remarkable growth, with combined real-world assets worth approximately $12.19 billion currently locked in decentralized finance applications. Industry analysts predict the market could surpass $50 billion by the end of 2025.

Ethereum remains the predominant platform for tokenization initiatives. eToro has a history with blockchain innovation, including pioneering cryptocurrency trading in 2013 after early investments in Bitcoin at $5 per coin.

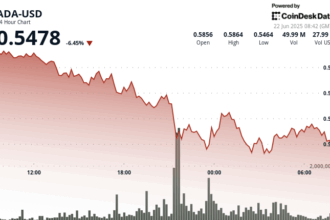

eToro experienced a nearly 10% year-to-date decline by Tuesday, though the news prompted discussion among traders following the market open. Concurrently, Ethereum trading hovered near $3,775 according to crypto data providers.

Implications of Tokenization

The eToro initiative represents another milestone in the growing convergence of traditional finance (Web2) and decentralized technologies (Web3). Tokenization enables fractional ownership and automated settlement processes, potentially increasing market accessibility.

“Tokenization of real-world assets reduces counterparty risk while enhancing liquidity,” commented market analyst Lisa Zhang. “We’re seeing institutional adoption accelerate as infrastructure improves and regulatory frameworks develop.”

The 24/7 accessibility aspect addresses a core limitations of traditional stock exchanges, potentially drawing retail investors seeking more flexible investment options. However, volatility and regulatory uncertainty persist as key challenges.