Surprise Fed Rate Cut Could Spark Capital Shift to Risk Assets like Bitcoin

Key Takeaways

- A Federal Reserve interest rate cut could reduce the appeal of fixed income assets, potentially shifting capital towards riskier investments like Bitcoin.

- Bitcoin may benefit significantly from a rate cut due to enhanced liquidity and increased risk appetite under loose monetary policy.

Analysts suggest a surprising Federal Reserve interest rate cut could reduce the yield advantage of fixed income assets, potentially increasing demand for higher-yielding risk assets such as Bitcoin.

Current Market Expectations vs. Potential Shift

While market expectations lean towards interest rate stability following the upcoming Federal Open Market Committee (FOMC) meeting, even a small cut could disrupt traditional fixed income returns. According to CME FedWatch data, the likelihood of rates remaining unchanged this week stands at 97%. However, analysts highlight that a reduction below the current 4% benchmark could push liquidity seeking capital towards alternative assets.

Such a move might diminish fixed income’s attractiveness relative to risk assets, supporting markets like Bitcoin.

Underlying Economic Conditions & Fed Dilemma

The meeting occurs amidst stronger-than-expected macroeconomic readings. The US economy grew at a 3% annualized rate in the second quarter, driven despite pre-meeting import surges influenced by President Trump’s trade policies. Recession probability forecasts have significantly declined on platforms like Polymarket.

Inflation has also moderated. The June Producer Price Index (PPI) showed its largest year-over-year decline since September 2024, rising just 2.3%. Policy uncertainty remains due to potential downstream effects from trade measures, despite minimal current impact on consumer prices.

Political Pressure & Fed Stance

President Trump continues to publicly pressure the Federal Reserve to cut rates, favoring “No Inflation” scenarios. However, Federal Reserve Chair Jerome Powell has not indicated any plan to alter policy direction ahead of the FOMC meeting.

Monetary Policy Impact on Bitcoin

The effects on Bitcoin are anticipated not only from direct interest rate movements but overall looser monetary conditions. However, its performance depends on broader factors, primarily the growth of the overall money supply—especially assets included in M2.

Increased liquidity typically benefits risk assets. A 25 basis point cut reduces the yield advantage of fixed income, potentially diverting significant assets ($25.4 trillion market) and spurring borrowing across the economy. This stimulates economic activity while raising the appeal of risk assets like Bitcoin.

Potential Bitcoin Price Impact

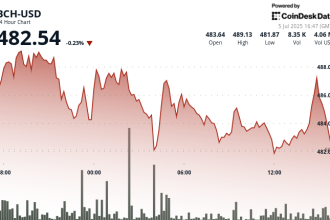

A rate cut could support a rally, but reaching $140,000 (approx. 19% from current $117,600) might require further market shifts. By comparison, a market cap of $2.78 trillion leaves Bitcoin $87% behind gold’s valuation. Such a peak Bitcoin valuation would still represent a comparatively modest fraction of the S&P 500’s $56.4 trillion market cap, suggesting limited upside relative gains possible elsewhere.

While the probability of a Wednesday cut remains low based on market pricing, should a reduction occur, Bitcoin positions may stand to be major beneficiaries as capital flows into risk exposures. The S&P 500, while also benefiting from such a scenario, has less proportional room for growth stemming from fixed income reallocation.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.