Bitcoin Candlestick Charts: A Beginner’s Guide

Key Takeaways

-

Bitcoin candlestick charts are popular among traders due to their simplicity and intuitive representation of market sentiment and trends.

-

The concept originated in 18th century Japan and was introduced to Western financial markets in the late 1980s.

-

They help identify bullish and bearish patterns that are essential for understanding Bitcoin’s short-term price movements.

-

Traders should combine candlestick analysis with other technical indicators, such as moving averages or the relative strength index.

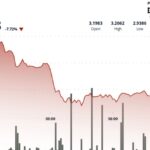

For beginners in Bitcoin trading, understanding when to buy or sell involves interpreting market data effectively. Candlestick charts, unlike simple bar or line graphs, provide a comprehensive visual representation of price action. With time displayed horizontally and price vertically, these charts offer an immediate snapshot of significant price movements during specific periods.

Why Analyze Bitcoin Price Charts?

Technical analysis has transformed Bitcoin trading, as investors borrowed strategies from traditional markets. Platforms like TradingView offer sophisticated charting tools with various indicators. While candlestick charts provide essential insights, beginners should also explore bar, line, and other chart types.

Beginner’s Guide to Candlestick Charts

Candlestick charts represent a fundamental component of technical analysis that can significantly enhance understanding of market dynamics. These visual tools illustrate price trends over specific periods – from hourly to daily intervals – providing valuable information for decision-making.

Why use candlesticks?

-

To visually understand price movements across different timeframes.

-

To identify market sentiment – bullish, bearish, or consolidation phases.

-

To recognize reversal or continuation patterns that can predict future price movements.

A single candlestick captures four crucial price points:

- Opening price at the start of the period

- Closing price at the end of the period

- High reached during the period

- Low reached during the period

The main body connects the opening and closing prices, while the wicks or shadows indicate the highest and lowest points during the period. Importantly:

-

Green candles represent bullish movement where closing price exceeds opening price.

-

Red candles (or hollow candles) indicate bearish movement when closing price is lower than opening.

Consider this example: Bitcoin opens at $90,000, closes at $93,500 with a $95,000 high and $88,700 low. The candlestick would appear with a green body from $90,000 to $93,500, featuring an upper wick at $95,000 and a lower wick at $88,700.

Advantages of Bitcoin Candlestick Charts

-

They offer quick insight into market sentiment and price movement direction.

-

Traders can select appropriate timeframes – one-minute charts for scalping, daily charts for swing trading.

With cryptocurrency markets operating 24/7, these charts effectively capture the global trading pulse continuously throughout the week.

Advanced Charting Techniques for Bitcoin Trading

Candlestick analysis forms the foundation, but traders should expand their technical toolkit. Consider these additional approaches:

1. Fibonacci Retracement

This tool identifies potential support/resistance levels using key mathematical ratios. Connect significant price extremes, then draw retracement lines at 23.6%, 38.2%, 50% and 61.8% intervals to anticipate corrective movements.

2. Volume Profile

Volume Profile displays trading activity against price levels. These zones identify crucial support/resistance points where significant buying or selling has occurred.

3. Elliott Wave Theory

This model identifies repeating price patterns based on mass psychology. According to the theory, markets move in five-wave trends followed by corrective three-wave movements.

4. Technical Indicators

- RSI (Relative Strength Index) measures price momentum balance.

- SMA (Simple Moving Average) calculates the average price over a specific timeframe.

- EMA (Exponential Moving Average) emphasizes recent price action, making it more responsive to current market conditions.

Caution! Chart analysis should always be combined with proper risk management. These tools provide probabilities, not certainties. Never trade beyond your financial capacity.

This content is for informational purposes only. Cryptocurrency investments are highly speculative and carry significant risk of loss. Conduct thorough research before making any trading decisions.