Analysis: Google’s Gemini Platform Offers New Tools for Crypto Market Sensemaking

Executive Summary

The cryptocurrency market is subject to significant volatility, often driven by regulatory developments. Google’s Gemini generative AI platform is emerging as a powerful tool to help traders and investors navigate this landscape.

By aggregating diverse information sources, analyzing market sentiment from social media, identifying beneficiary and vulnerable sectors, and generating structured trading ideas, Gemini exemplifies how AI innovation is reshaping financial information consumption and decision-making.

This analysis explores how Gemini’s capabilities can provide distinct advantages for crypto participants facing information overload during periods of market uncertainty.

The Complexity Challenge: Crypto News Overload

In late July 2025, the U.S. House passed three significant pieces of cryptocurrency legislation, exemplifying how fast-moving events can overwhelm market participants with complex information. Typical responses involved:

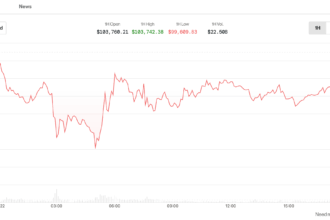

- Immediate price checks for major cryptocurrencies

- Social media immersion feeding into Fear Of Missing Out (FOMO) or Fear, Uncertainty, and Doubt (FUD)

- Subsequent difficulty consolidating a coherent understanding

Traditionally, processing such events required hours of manual research across various information channels, vulnerable to bias and cognitive fatigue. Large Language Models (LLMs) are fundamentally changing this landscape.

Gemini: Augmenting Crypto Intelligence

Gemini represents a significant evolution in AI-powered financial tools. Its core strength lies in transforming raw information into analyzable intelligence, executing complex analytical tasks previously requiring significant human effort.

A Four-Pronged Approach

Gemini excels at synthesizing information from diverse sources:

- Consolidated summaries balancing mainstream (“Bloomberg style”), industry-native (“Cointelegraph insights”) and technology-focused perspectives (“Wired angles”)

- Instant extraction of key regulatory provisions like stablecoin rules, asset classification criteria, and prohibitions (e.g., CBDC bans)

Understanding market psychology requires analyzing expert and community reactions. Gemini automatically interprets social media sentiment:

- Quantifying positive/negative/neutral reactions across verified X accounts and financial media

- Highlighting impactful nuances (e.g., support for regulatory clarity vs. concerns about DeFi impacts)

Gemini identifies winners and losers based on regulatory content and market sentiment:

- Pinpointing immediate beneficiaries (regulated exchanges, compliant stablecoin issuers) versus vulnerable areas (centralized DeFi projects, potential CBDC competitors)

According to Gemini analysis: “Regulatory precision creates winners (Circle, Coinbase) while challenging the periphery of centralized DeFi”

Gemini creates actionable intelligence by translating market signals into concrete trading parameters:

- Generating multiple-month Bitcoin price targets

- Establishing data-supported confirmation levels and trailing stop mechanisms

- Systematically identifying key risk factors (security, competition, partnership dependence)

Balanced, research-grounded suggestions rather than predictive assertions.

Technology Corner: Gemini’s Role

Launched as Bard before the 2024 rebranding, Gemini leverages advanced LLM capabilities specifically relevant to financial analysis. Its distinct utility comes from:

- Incorporation of financial entity knowledge bases

- Sophisticated sentiment extraction algorithms

- Ability to structure complex information into actionable formats

Unlike pure language models, Gemini explicitly targets financial and regulatory intelligence applications. Its reported performance matches top alternatives in structured analytical tasks.

Case Study: US Regulatory Clarity Event

Applying Gemini step-by-step to the US crypto bills of July 17, 2025:

Risk vs. Opportunity Matrix

| Beneficiaries | Risk Areas | Momentum Impact |

|---|---|---|

|

|

|

Conclusion: “Clear US asset definitions, coupled with confidence in enforcement, historically correlate with stronger institutional Bitcoin participation,” noted the Gemini assessment.

The Offer and the Caution

Gemini offers powerful analytical tools. However, responsible technology adoption requires critical caveats:

- AI synthesizes information, but lacks human judgment of underlying predictive value

- No substitute for due diligence, personal risk tolerance considerations, or full verification

This article serves informational/generative purposes only. All trading activity involves significant risk.

[Analysis synthesized from public technical information and demonstration examples available through Gemini platform exploration]

Important Note: The views and information presented in this analysis represent independent considerations, not investment advice or recommendations. Market activities inherently involve substantial risk.

Seasoned digital economist analyzing AI’s impact on financial markets and emerging technologies.