Internet Computer

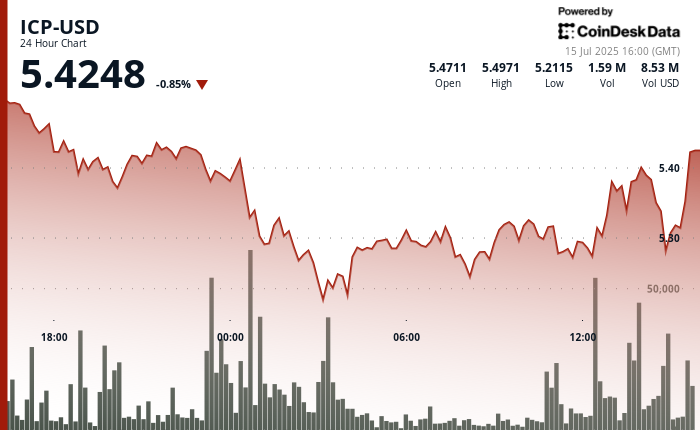

saw a volatile 24-hour stretch marked by early selling and a sharp rebound After falling to $5.27, the token recovered into the close to settle at $5.4324 – trimming losses after a 3.47% daily decline. The turnaround came amid renewed optimism driven by the official launch of Caffeine, a next-generation AI-powered Web3 platform built on ICP.

Unveiled on July 15, 2025, at the “Hello, Self-Writing Internet” event in San Francisco, Caffeine empowers users to build decentralized apps using natural language — no code required. The platform’s debut marks a significant milestone in Internet Computer’s strategy to merge on-chain AI with seamless dapp creation, helping to ignite buying interest late in the day.

However, the landscape shifted after 14:30 UTC on Tuesday. ICP dropped to $5.27 but then reversed higher on a series of institutional-sized volume spikes. This flurry of activity lifted the token back to $5.34, narrowing the day’s losses and reinforcing buyer presence around the $5.27-$5.28 support band.

Fundamental progress further bolstered sentiment. The DFINITY Foundation has burned over 1 million tokens to tighten supply, while its new vetKeys privacy protocol addresses critical concerns in blockchain data security.

With AI now live on-chain via Caffeine and technical buyers stepping in near key support, ICP appears poised to test resistance at $5.40 once again, backed by ecosystem momentum and strategic upgrades.

Technical Analysis Highlights

- ICP fell 3.47% in 24 hours, with a $0.30 intraday spread from $5.50 to $5.2115.

- Caffeine’s launch introduced AI-powered dapp creation, driving bullish sentiment.

- Bears pushed price lower early; $5.20 support held firm on heavy overnight volume.

- A rebound lifted ICP from $5.27 to $5.34 after a wave of accumulation.

- Notable volume surges: 14:52 (41,106), 15:03 (44,658), 15:29 (17,658).

- Resistance remains at $5.40–$5.42, where rallies repeatedly paused.

- Support re-established at $5.20–$5.28 following recovery.

- Current price: $5.4324, holding above intraday lows and showing upward bias.