Cryptocurrency ETPs See Record Inflows Despite Bitcoin Decline

Cryptocurrency investment products maintained strong investor interest last week despite notable price drops for major assets like Bitcoin and Ether.

Global crypto exchange-traded products (ETPs) recorded $1.24 billion in inflows for the trading week ending Friday, according to CoinShares. This inflow continued to set new year-to-date records.

James Butterfill, head of research at CoinShares, noted that the YTD inflow for crypto ETPs reached an all-time high of $15.1 billion.

Total assets under management (AUM) in crypto ETPs increased to $176.3 billion, up from $175.9 billion the prior week.

Bitcoin Leads ETP Inflows After Second Consecutive Week Growth

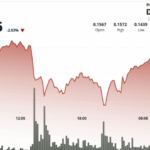

Bitcoin ETPs experienced inflows totalling $1.1 billion for the second consecutive week, despite Bitcoin’s price falling from approximately $108,800 on June 16 to $103,000 by week’s end.

Despite the declining spot price, crypto ETP flows remained robust, with Butterfill attributing this phenomenon to investors buying during price weakness. Short-Bitcoin product outflows also decreased slightly, contributing to positive sentiment.

Market Sentiment Shifts as Fear & Greed Index Briefly Signals “Fear”

The Crypto Fear & Greed index recently indicated cooling market sentiment, briefly dropping to “Fear” before recovering to “Neutral” status.

Butterfill explained that ETP sentiment declined during the latter part of the week, which he attributed to factors including the US Juneteenth holiday and reports about US involvement in the Iran conflict.

Near the end of the reporting period, both ETP flows and spot crypto prices demonstrated notable strength despite ongoing geopolitical tensions between Israel and Iran.

Furthermore, analysis suggests the likelihood of a Bitcoin ETF approach exceeds 90%, maintaining market optimism despite recent price corrections.