Trump Media & Tech Group Confirms $2.3 Billion Bitcoin Treasury Plan

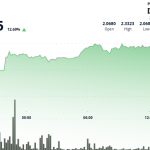

President Donald Trump’s company, Trump Media and Technology Group (TMTG), owner of Truth Social, confirmed its plan for a $2.3 billion Bitcoin treasury while simultaneously announcing a separate $400 million share buyback program.

The company declared in Monday filings that its board authorized repurchasing up to $400 million in common stock. TMTG explicitly stated the stock buyback does not conflict with its strategy to allocate approximately $2 billion of its funds toward a “Bitcoin treasury.” Earlier reports had indicated potential $3 billion crypto fundraising.

In a subsequent confirmation, TMTG detailed its Bitcoin investment strategy involves “a private placement offering of approximately $2.3 billion in the aggregate.” This funding source derives from the resale of 56 million shares and 29 million shares tied to convertible notes, as previously disclosed to the SEC.

The US Securities and Exchange Commission (SEC), which Trump nominee Paul Atkins chairs, approved TMTG’s registration statement for the Bitcoin investment in June, validating the funding structure.

Separate Crypto Fundraising Attempt?

Additionally, TMTG has submitted applications to launch a spot Bitcoin exchange-traded fund (ETF), including separate filings for shares linked to a “dual ETF” involving both Bitcoin (BTC) and Ether (ETH). Following the SEC’s January 2024 approval of spot Bitcoin ETFs and May 2024 approval for Ether ETFs, industry analysts anticipate regulatory scrutiny on TMTG’s proposals.

The reserves would hold digital assets forfeited to the US government, but Trump advisers have suggested other ways of expanding the stockpile.

Political Controversy and Proposed Legislation

Amid these developments, Trump announced in an executive order in March the establishment of a potential “Strategic Bitcoin Reserve” and a “Digital Asset Stockpile.” Lawmakers on the Senate Permanent Subcommittee on Investigations voiced concerns, accusing the President of using his office to “enrich cryptocurrency firms” via asset stockpiles.

The same day TMTG announced its treasury plan, California Senator Adam Schiff introduced legislation aimed at barring the President, First Family, and other public officials from issuing, sponsoring or endorsing digital assets. Should this legislation pass, TMTG’s proposed strategy could be deemed illegal.

The proposed Senate bill specifically targets activities like those planned by Trump’s company. The White House has previously stated the President supports “the use and development of digital assets and blockchain technology.” However, administration officials have also publicly opposed executive orders establishing government-controlled Bitcoin reserves.

TMTG’s Financial Moves

TMTG’s financial maneuvers follow a pattern of significant stock transactions. In March, the company raised $500 million by selling shares, a move criticized for reducing stakeholder value just days after its initial public offering (IPO). The company has also faced criticism over accounting practices.

Related: Crypto ETFs Gain Traction

Meanwhile, institutional interest in digital assets continues to grow, with established financial institutions launching their own Bitcoin ETFs and related products following the SEC approvals. TMTG’s entry into this space, however, faces questions regarding its financial stability and regulatory compliance.

TMTG’s Bitcoin Strategy Authorization

TMTG’s authorization letter to its board regarding the Bitcoin treasury strategy explicitly details the funding mechanism: “This offering will be funded through the sale of the shares and warrants underlying the offering.” The company emphasizes the investment is “solely and unconditionally for the purpose of purchasing, holding, and managing” Bitcoin.

Analysts note that while the company has acknowledged SEC approval for the financing, questions remain regarding its financial capacity and strategic rationale for holding a substantial Bitcoin treasury.

Political Fallout Expected

The timing and nature of these announcements, occurring simultaneously with proposed legislation targeting the President’s crypto activities and amidst ongoing investigations into the Trump Organization, suggest heightened political sensitivity. Legal experts anticipate continued scrutiny of TMTG’s actions.