The luxury real estate giant is positioning itself at the forefront of crypto-finance.

Christie’s International Real Estate has established a new division focused on facilitating property transactions using digital assets.

Reported Portfolio Valuation

According to reports, the company now offers over USD 1 billion worth of high-end residential properties payable entirely in cryptocurrency.

Transactions can be conducted using established digital currencies such as Bitcoin (BTC) and Ethereum (ETH) without requiring traditional banking intermediaries.

LA Base and Leadership

The new division is headquartered in Los Angeles and spearheaded by prominent real estate broker Aaron Kirman. This move signifies a potential standardization in accessing global luxury real estate through digital financial instruments.

“Crypto is here to stay,” stated Kirman. “It’s only going to get bigger over the next few years.” He emphasized the need for the luxury market to adapt.

Validation via High-Profile Deal

The division’s creation reportedly stemmed from the landmark sale of a USD 65 million Beverly Hills mansion completed entirely with digital assets. This transaction demonstrated significant demand among wealthy crypto holders for discreet property acquisitions bypassing conventional financial institutions.

This USD 65 million sale showcased the willingness of ultra-wealthy individuals to utilize Bitcoin for substantial real-world acquisitions.

Designed for Privacy and Efficiency

The peer-to-peer process utilizes digital wallets for direct payment transfer between buyers and sellers, circumventing traditional financial networks. A notable feature discussed is enhanced privacy, a factor potentially attractive to high-net-worth individuals including celebrities, tech entrepreneurs, and digital asset investors seeking anonymity.

Christie’s suggests using LLCs funded directly with digital assets helps obscure ownership details.

Avoiding face-to-face meetings and handling verification and compliance through legal counsel are other mechanisms discussed, further minimizing transaction visibility, with Bitcoin providing both speed and traceability reduction attributes valued in the luxury market to avoid unwanted attention.

Portfolio and Risk Mitigation

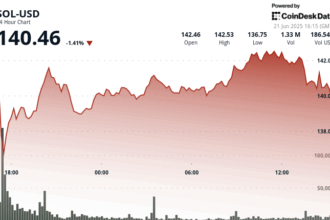

The division offers this unique purchasing option across Christie’s diverse portfolio of premium properties. While noting the volatility compared to fiat currencies, the company mitigates risk through real-time digital asset price feeds and escrow services.

Furthermore, Christie’s implements robust due diligence, including checks on the source of funds, aimed at achieving financial compliance and mitigating money laundering risks.

Regulatory Awareness

The increased adoption is drawing regulatory attention. The Federal Housing Finance Agency (FHFA) has reportedly instructed Fannie Mae and Freddie Mac to consider digital assets as a mortgage qualification method.

Simultaneously, legislative proposals like the GENIUS Act and CLARITY Act aim to establish clearer frameworks for cryptocurrency transactions.

Future Prospects: Banks as Facilitators?

Christie’s is currently exploring partnerships with major financial institutions to develop crypto-backed mortgage structures, potentially transforming the accessibility of real estate finance.