Chainlink (LINK) Poised for Rally, Analysts Note TradFi/DeFi Convergence

The integration of traditional finance and blockchain technology may provide significant tailwinds for Chainlink’s LINK token.

At the RWA Summit Cannes, Nelli Zaltsman, Head of Blockchain Payments Innovation for JPMorgan Kineticly’s Kinexys division, underscored the accelerated convergence between traditional (TradFi) and decentralized (DeFi) finance. This institutional interest towards blockchain is focused immediately on Chainlink.

Speaking at an event focused on real-world assets (RWA) in Cannes, Zaltsman revealed that a collaborative effort between banking giant JPMorgan Kinexys and Ondo Finance has successfully completed a pilot using Ondo’s Chainlink oracle service.

The pair executed a cross-chain Delivery versus Payment (DvP) test transaction. This involved a permissioned payment network and a public, test blockchain net, demonstrating interoperability.

The landscape is shifting as traditional financial institutions increasingly explore on-chain technologies. This movement could significantly boost demand for Chainlink, a key infrastructure for DeFi applications.

Price Trend Analysis

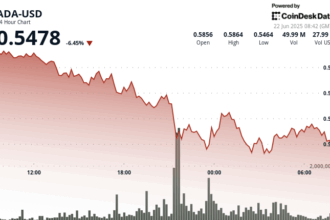

Currently, LINK has been trading within a large consolidative range, oscillating between approximately $10.94 and $18 over recent months.

The immediate focus is on the $18 resistance level. If LINK successfully breaks above this threshold, it enters a positive technical setup.

Current analysis points to two key scenarios:

-

Supportive Scenario: If the price dips but holds above the 20-day EMA (currently providing support around $14.85), it suggests underlying buying pressure. This increases the likelihood of a sustained move above $18, potentially completing a double-bottom pattern.

- Restrictive Scenario: A sharp decline triggering a breach below the $14.85 EMA ($14.70 is mentioned) suggests continued range-bound consolidation.

Chart analysis also notes that buyers have consistently halted pullbacks near the 20-day EMA recently, "arresting the pullback" as described, indicating a support zone where buying interest is present.

Technical Indicators and Levels

- $18: Resistance level

- $14.70: Potential breaking support level in the restrictive scenario

- $14.85: 20-day EMA, key support zone

- $14: A lower support level if stronger declines occur

The potential upside target, if the double-bottom pattern breaks out successfully, could reach $25.06.

The 4-hour chart specifically shows:

- Bulls preventing dips toward the 20-EMA

- If the $18 price test fails sharply and breaks below the 50-SMA, the outlook worsens.

In a Nutshell

The successful RWA test involving JPMorgan and Ondo, utilizing Chainlink, highlights tangible TradFi-DeFi convergence. This partnership and the banter against a major financial institution could translate into increased traction for the LINK token.

However, technical analysis underscores that holding near-term support is crucial for breaking the current consolidation range and initiating an upward trend. The outcome near the $18 threshold appears pivotal.

This article is not financial advice. Investing involves risk, and past performance does not guarantee future results.