Investment Update: MEXC Ventures to Fund Indonesian Exchange Triv at $200M Valuation

Global cryptocurrency exchange operator MEXC Ventures has strategically invested in Indonesian digital asset platform Triv, valuing the latter at $200 million and securing its backing at an undisclosed equity stake. The deal structure, confirmed as pure equity without token or convertible instruments, underscores MEXC’s commitment to investing in licensed exchanges within Southeast Asia.

In Brief

- MEXC Ventures has provided equity funding to Indonesian crypto exchange Triv, backing the platform at a $200 million valuation.

- The investment strictly follows equity terms, aligning with MEXC’s strategy of long-term backing for compliant exchanges in the region.

- Triv maintains operational independence post-investment but will gain increased liquidity and expanded product support.

- The deal coincides with regulatory shifts in Indonesia impacting domestic cryptocurrency sellers.

This strategic investment from MEXC Ventures highlights the growing focus on Southeast Asia’s maturing crypto landscape. Triv, established in 2015 and boasting over three million registered users, operates a comprehensive suite of trading services fully licensed for spot trading, staking, and derivatives. The platform supports more than 1,000 digital assets, including prominent names like Bitcoin and Ethereum, alongside niche coins and synthetic stocks.

According to Leo Zhao, Investment Director at MEXC Ventures, the “proven market leadership, regulatory compliance, and user base of Triv made it a strategic fit”. He explained the investment serves MEXC’s broader regional expansion goals: “Our ambition is wider than just crypto-cross-border services; reaching high-potential, regulated markets is key.”

Triv anticipates leveraging this partnership “to expand products, boost market liquidity, and strengthen infrastructure amid increasing regulatory expectations”, without compromising operational autonomy. MEXC Ventures has indicated a possibility of following up this investment in Indonesia with further regional ventures.

Context: Indonesia’s Evolving Crypto Regulation

The timing of MEXC’s investment comes alongside significant regulatory shifts in Indonesia. Effective early this month, a major change to the country’s crypto tax policy was implemented. Sellers of digital assets via domestic exchanges now face a final income tax rate of 0.21% on domestic platforms, nearly doubling the previous rate. Transactions using overseas platforms incur a higher 1% levy. Importantly, however, cryptocurrency purchases by consumers are no longer subject to value-added tax.

Tokocrypto, another Indonesian exchange affected by these changes, noted these regulations signal Indonesia’s reclassification of crypto assets as financial instruments. This landmark shift handovers oversight responsibilities from the commodities regulator BAPPEBTI to the Financial Services Authority (OJK), marking Indonesia’s entry into a more formal and regulated “institutional phase” within Southeast Asia’s dynamic crypto market.

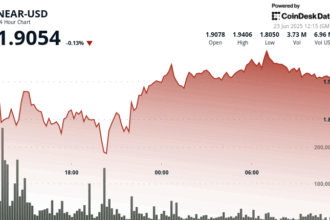

All information in this report is accurate as of the current data cutoff and relies solely on publicly available sources and relevant organizational disclosures. Crypto market conditions can change rapidly and are subject to significant volatility and regulatory uncertainty.