MicroStrategy CEO Michael Saylor dismissed concerns of a cryptocurrency market “winter.” speaking on Tuesday.

“Winter is not coming back,” Saylor told Bloomberg. “We’re past that phase. They say Bitcoin isn’t going to zero. It’s going to one million.” Saylor’s company, MicroStrategy, holds significant Bitcoin reserves purchased since 2020.

A Rally to $1 Million Targeted

Saylor bases his optimistic forecast on anticipated increased institutional adoption contrasted with constrained Bitcoin daily supply.

“At the current price level, it only takes $50 million to turn the entire driveshaft of the crypto economy one turn.”

Supply Constraints and the $50 Million Threshold

Saylor highlighted that approximately 450 Bitcoin are available for sale daily by miners. Valued at ~$50 million at Tuesday’s price, he stated, “If that $50 million is bought, then the price has gotta move up.” He noted that public companies buying Bitcoin are acquiring the “entire natural supply,” referencing MicroStrategy’s accumulation of over 582 thousand BTC.

However, Saylor cautioned that a sharp rally may precede a subsequent decline. “If Bitcoin’s going to $500,000 or $1 million, I think there’s a good chance we’ll see a crash down,” he noted, with potential downside of about $200,000 per coin.

Broader Economic Factors

Saylor asserted the necessary confirmations for his forecast exist but chose not to detail them. He emphasized ongoing institutional adoption, including investments from firms like BlackRock, growing traditional banking acceptance (including custody services), and presidential support from Donald Trump.

“Bitcoin has gotten through its riskiest period; the accounting has been corrected,” Saylor stated.

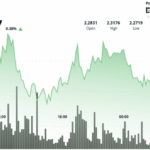

Despite Trump’s vocal backing, Saylor acknowledged the impact of recent US tariffs on cryptocurrency markets. Furthermore, he mentioned increasing interest from nation-states, citing Pakistan’s announced plan for a strategic Bitcoin reserve as a key “confirmation.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.