MicroStrategy Faces S&P 500 Inclusion Hurdle Amid Bitcoin Volatility

Analyst Jeff Walton calculates approximately a 91% chance for MicroStrategy’s (MSTR) inclusion in the S&P 500, contingent on Bitcoin maintaining a price above $95,240 during the second quarter.

Speaking Tuesday in a video analysis, financial analyst Jeff Walton suggested that Michael Saylor’s MicroStrategy, colloquially known as “Strategy,” stands at a high probability (approximately 91%) of joining the S&P 500 index provided Bitcoin does not experience a 10% decline before the quarter’s end.

S&P 500 Eligibility Criteria

Walton outlined that the S&P 500 index requires companies to demonstrate positive total earnings spanning the preceding four quarters to qualify for inclusion. MicroStrategy, despite holding the largest Bitcoin portfolio among listed companies, has reported consecutive net losses in the past three reporting periods, creating the current obstacle.

The analyst further explained that a significant drop below the $95,240 mark would likely prevent MicroStrategy’s second-quarter earnings from surpassing the cumulative losses recorded in the previous three quarters.

Data-Driven Probability Assessment

Walton’s forecast is predicated on Bitcoin’s current price of approximately $106,044 and a historical analysis of Bitcoin’s behavior during six-day periods since September 17, 2014. He observed that over these intervals, Bitcoin has declined by more than 10% in 343 instances, occurring approximately 8.7% of the time. This data point suggests a 91.3% probability of minimal volatility over the remaining six days of the quarter.

Analyzing the temporal aspect, Walton highlighted a notable increase in Bitcoin’s probability of avoiding a 10% fall as the quarter nears its conclusion. The probability climbs to approximately 92.4% if the quarter ends in five days, rising further to 93.4% with four days, 94.5% with three, 95.8% with two, and a near 97.6% chance with just one day remaining.

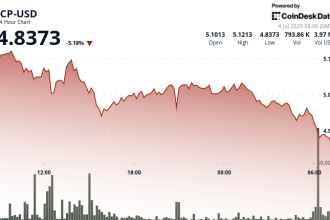

Recent Market Fluctuations

Despite recent dips, the crypto market has largely held steady. Geopolitical tensions between Iran and Israel caused Bitcoin to briefly fall below the $100,000 threshold for the first time since early May. However, the cryptocurrency has since recouped much of that ground, trading at $106,200 at press time.

Industry Significance

A successful inclusion for MicroStrategy would represent another noteworthy achievement for the crypto sector this year. Coinbase previously made history as the first cryptocurrency company to be added to the S&P 500 index in May. Industry representatives have highlighted this development as a significant marker of institutional acceptance for the cryptocurrency industry.

Meryem Habibi, chief revenue officer at Bitpace, commented, “It cements the legitimacy of an entire asset class.” Furthermore, MicroStrategy’s inclusion in the Nasdaq-100 Index was announced in December 2024 by Nasdaq, featuring the 100 largest stocks by market capitalization listed on the exchange.

Analysts view this potential S&P 500 inclusion as a pivotal moment for the cryptocurrency asset class, reflecting growing institutional recognition and integration of the technology.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.