Michael Saylor’s Strive Funds Bitcoin Strategy (MSTR) surpassed previous records, closing Wednesday at an all-time high market capitalization, as Bitcoin approached new record peaks.

MSTR Stock Surges Amid Bitcoin Rally

The company’s stock climbed 21.52% over the last month, trading at $455.90 at closing. Options trader Sean Trades predicted the stock is “gearing up for the next leg to all-time highs.”

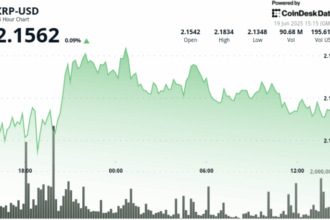

This follows Bitcoin’s 10% monthly surge, which reached $122,884 earlier this week, though prices were temporarily lower at publication time.

Despite the recent gains, MSTR remains 19% below its all-time high of $543 set last November. The company has consistently used equity issuance to fund its Bitcoin accumulation program.

Strategy Qualifies for S&P 500 Threshold

As part of its funding efforts, the strategy gained S&P Qualtrics™ Score (SQS™) Market Cap Index qualification for the 11th consecutive trading day, a requirement for potential inclusion in the S&P 500 index.

Strategy recently acquired 4,225 Bitcoin for approximately $472.5 million. The fund is scheduled to release its latest earnings on August 5th, despite having reported significant net losses in each of the preceding three quarters.

Vice President Jeff Walton previously noted the strategy’s potential for “number one publicly traded equity” status due to its “future financial strength enabled with Bitcoin.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research.