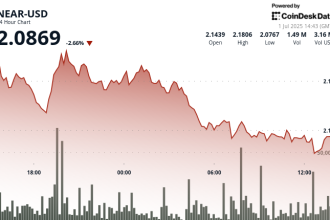

Binance Price Dip After Listing Query Reminds Analysts of Elevated Risk

A technical analysis of the four-hour Bitcoin chart reveals only three successful closes above $108,000 in the past 30 sessions, the bulk below $108K. Recent action challenges conventional support levels, with the 50EMA struggling to contain dips below $107K.

The struggle to penetrate a key resistance region highlights persistent selling pressure and a lack of coordinated buyer efforts. This level, historically breached eight times over its entire existence, remains unresolved.

Despite the difficulty in closing above $108,000, analysts note several factors maintain bullish sentiment. The relatively high trading volume, seller resistance near critical psychological thresholds, and the presence of open long positions suggest underlying buyer conviction among participants.

The evolving market requires close monitoring of a few critical indicators: the tendency for rapid price reversals near recent tops, the consistent discount at which futures contract bids the immediate July high, and the alignment of stop-loss orders just below current price zones.