This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

Eleven days into the second half of 2025, Bitcoin is already reaching multiple all-time high prices, most recently surpassing $118,000.

As this Bitcoin new all-time high is recorded on the 2025 crypto bingo card for the second half of the year, the question arises: what further milestones might we witness in the remaining six months?

Besides this price surge, corporate Bitcoin purchases have increased significantly, with industry observers expecting more institutional platforms to open access to the asset.

“With the possibility of a huge regulatory rug-pull removed, institutional investors would have a green light to invest in the space in earnest,” said Casey.

Commenting on Bitcoin’s trajectory, Ledn CIO John Glover still targets the $136,000 level but anticipates this milestone will be reached more quickly than originally projected.

Glover subsequently forecasts a correction down to between $91,000 and $109,000 before the price ascends again.

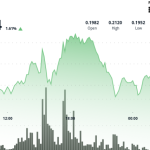

Source: TradingView

Benchmark’s Mark Palmer identifies the most critical upcoming catalyst for the crypto ecosystem as the CLARITY Act — a framework to classify crypto tokens as either commodities or securities — becoming law.

Meanwhile, data shows crypto-M&A activity reached unprecedented levels in the second quarter, according to Architect Partners. The firm reported 78 transactions, which is an all-time record. This includes Ripple’s acquisition of Hidden Road and Coinbase’s purchase of derivatives exchange Deribit.

Source: Architect Partners

Eric Risley, founder of Architect Partners, suggests we are entering a long-term uptrend in crypto-M&A as traditional financial services organizations increasingly recognize crypto’s strategic value.

“Certainly quarter-to-quarter fluctuations will persist, but the fundamental drivers of these mergers and acquisitions are now quite apparent,” Risley stated.

Rising assets under management in crypto investment products reached an all-time high of $188 billion, according to CoinShares data.

Following the debut of US spot Bitcoin ETFs 18 months prior, net inflows have totaled $51 billion (including yesterday’s near-record $1.2 billion daily inflow). US ether ETFs saw their second-best daily inflow yesterday, totaling $383 million.

Additional crypto ETFs (single-asset and index types) are expected in 2025, though timelines remain uncertain.

For those seeking crypto exposure through equities, market participants will be monitoring the outcome of Circle’s upcoming IPO. Watchlist companies include Gemini and Kraken.

Regarding tokenization, industry estimates by Bitwise and VanEck predicted the tokenized securities market would reach $50 billion in 2025. Industry experts suggest at least one major announcement could be expected later this year as traditional financial institutions such as Schwab explore digital asset integration.

Crypto journalists and market participants remain engaged and active in analyzing these developments.