This is a segment from the Forward Guidance newsletter. To read full editions, please subscribe.

We are entering a crucial phase where the economic impact of existing tariffs and corporate responses to price increases are becoming visible.

Current tariff rates are frequently updated. The effective rate under the China 90-day pause agreement stands around 12.6%.

Tariff revenue collections are also actively increasing.

Companies are now faced with the key decision: absorb cost increases internally or pass them on to consumers. The outcome of this calculus will significantly shape economic conditions over the next twelve months, determining which entities bear the costs.

Recent economic data offers preliminary insights:

PPI

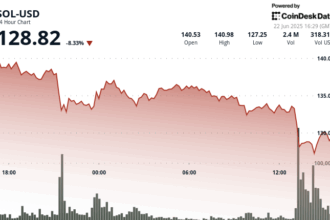

Today’s Producer Price Index (PPI) report included a notable downside miss. This was largely attributed to a substantial decline in portfolio management fees, driven by the market crash in April.

Ledger

The report masks another dynamic: whether corporations are passing cost increases to consumers or internalizing them. Economist Parker Ross suggests that for now, tariffs are absorbing a larger share.

“So far, it looks like the impact of tariffs is largely not being passed on to consumers, but they appear to be being passed on to businesses.,” Ross commented.

“We see this in the limited acceleration in PPI for core finished consumer goods contrasted against the sharp acceleration in PPI for private capital equipment (up 0.61%), the strongest monthly gain outside of the pandemic since 2008.”

Retail Sales

Retail sales data released today highlights shifting consumer behavior in tariff-affected categories.

Items not tariff-bound, like food services, saw strong sales increases. Conversely, categories bearing large tariff impacts, especially big-box retailers and sporting goods (where significant “frontrunning” occurred ahead of tariff implementation), are now experiencing significant sales declines (“cratering”).

Ledger

This pattern illustrates a likely national economic sequence as the tariff situation develops: initial “frontrunning,” followed by widespread price increases, potentially culminating in demand destruction.

Looking ahead, the upcoming months will likely bring significant noise in economic data. Therefore, analysts stress the critical need to look beyond surface-level statistics to understand the underlying drivers.