Pepe

, the world’s third-largest stablecoin by market value, has failed to keep gains above the 100-day simple moving average (SMA) amid continued distribution or selling by holders.

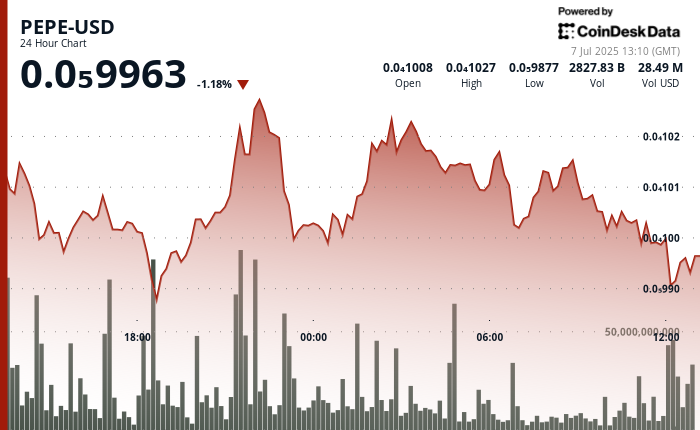

Broadly speaking, the token remains locked in a sideways range identified by trendlines connecting June 25 and July 3 highs and lows registered on June 22 and July 2. A breakdown of the channel would imply a continuation of the downtrend from May 23 highs.

Key AI insights

- Technical indicators for PEPE remain mixed, with RSI at 44.29 and sentiment classified as neutral.

- The token’s price action during recent hours showed a sharp sell-off with exceptionally high volume, creating a descending resistance trendline.

- Despite these challenges, analysts project significant long-term potential, with some forecasts suggesting PEPE could reach $0.000035 by 2025 and potentially $0.0258 by 2030.

- PEPE coin maintains critical support at $0.00000099 despite profit-taking, forming a consolidation pattern between $0.0000099 and $0.0000102.

- Memecoin sector shows rotation with Bonk surging 6-7% on ETF buzz while Dogwifhat drops 4-10%, testing key support amid declining volume.